In the cryptocurrency family, Bitcoin is the star child. It was the first widely accepted cryptocurrency and still the most popular one. The bright halo of Bitcoin often overshadows other less known cryptocurrencies.

The term “altcoin” is used to describe cryptocurrencies other than Bitcoin. This word is counterproductive because it reduces the complexity of the cryptocurrency world into only two categories–Bitcoin and the others. Cryptocurrencies are diverse and exciting. While Bitcoin’s main use is to serve as digital cash, many other cryptocurrencies aim to solve problems far more complex with the blockchain technology.

Often, these cryptocurrencies are less saturated and overvalued than Bitcoin. A good understanding of the other members of the cryptocurrency family could help you spot the dark horse that could change the future and grow your investment.

This article is your road map to explore the diverse world of cryptocurrencies. We guide you through the different exciting applications of cryptocurrencies and some important cryptocurrencies that you must know.

Cryptocurrencies you must know

Bitcoin Cash

Ticker – BCH

Price (December 15th, 2019) – $208

Market Cap (December 15h, 2019) – $3,775,716,898

What is Bitcoin Cash?

Bitcoin cash is the twin brother of Bitcoin. It is a version of Bitcoin separated from the Bitcoin network in 2017. As its name suggests, Bitcoin cash is intended to be used in everyday transactions just like traditional cash. Bitcoin Cash differs from Bitcoin in a few ways but the main difference is its stronger transaction processing capacity.

While Bitcoin Cash still uses the same base code as Bitcoin, it has increased the block size to allow more transactions to be processed with lower transaction fees. Bitcoin cash can process 61 transactions per second. That is almost nine times of Bitcoin’s processing speed (7 transactions per second). This makes Bitcoin cash more suitable to be used by consumers for daily transactions.

Ripple

Ticker – XRP

Price (December 15th, 2019) – $0.22

Market Cap (December 15th, 2019) – $9,487,462,554

What is Ripple?

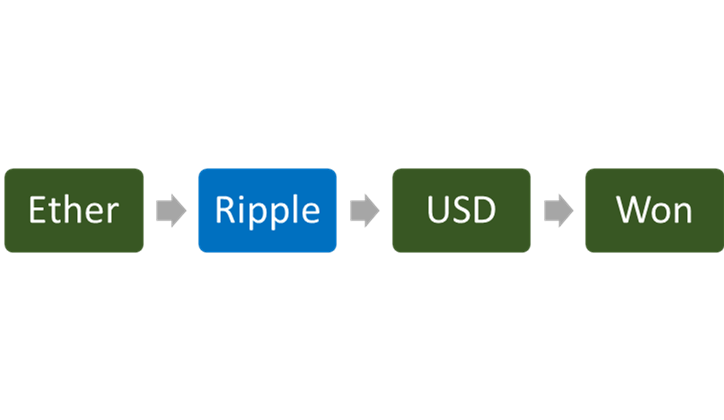

Ripple is a global payment network that facilitates international transfers. The Ripple network can convert any currency or valuable to other currencies quickly and efficiently. For example, if you want to convert Ethereum to Korean Won, the Ripple network will find the best way to complete the conversion. Often this requires a series of intermediary transactions in the network. An example transaction looks like this:

In this example, the Ether is first converted into ripple (XRP) and then converted to dollars. Finally, the network converts the dollars into Korean wons. The path for each transaction is optimized based on transaction costs and the availability of different currencies in the network. The Ripple network is designed to find the most efficient transaction solution.

As demonstrated in the previous example, the Ripple network connects previously fragmented buyers, sellers, and markets through its network. Traditionally, sending money to a different country requires multiple financial institutions to work together. The transactions often take days to complete. The ripple network can complete such transactions within one network, greatly increasing the speed and reducing the costs.

XRP is the native currency of the Ripple network. It facilitates transactions as an intermediary. For example, if there is no direct conversion between two currencies, the network will first convert one currency into XRP and then convert the XRP into the target currency. Ripple users can use XRP to cover transaction fees or trade XRP on cryptocurrency exchanges as an investment.

Unlike many cryptocurrencies, Ripple is not built on a blockchain. It is built around the Ripple Protocol Consensus Algorithm. Ripple transactions are verified by trusted parties in the network such as banks and credit card companies. This means that the Ripple is a decentralized blockchain system. However, using trusted parties helps Ripple process transactions much faster than Bitcoin.

In short, Ripple is a global payment network that allows users to send any currency globally including Bitcoins. Additionally, Ripple is built on a consensus protocol and can facilitate transactions cheaper and faster.

Ethereum

Ticker – ETH

Price (December 15th, 2019) – $143.64

Market Cap (December 15th, 2019) – $15,645,850,549

What is Ethereum?

Ethereum is a platform that hosts and supports blockchain applications. In 2013, Vitalik Buterin came up with the original concept of Ethereum. He believed that the blockchain technology behind Bitcoin can be used to support applications far more complex than digital cash. Ethereum was born to support the development and operation of blockchain applications.

Blockchain applications are also known as decentralized applications (dapps). Dapps are built on a blockchain and have all the qualities of a blockchain. They are secure, decentralized, and transparent. Some examples of dapps developed on Ethereum include investing apps, digital identity, and digital collectibles. You can even build another cryptocurrency on Ethereum!

Programmers are able to build their own blockchain applications on Ethereum. Dapp developers use Ethereum’s own cryptocurrency, Ethers, to pay for services in the Ethereum network. Ether is the fuel that drives the entire Ethereum economy. In addition its use-value, you can trade Ether on cryptocurrency exchanges as an investment even if you are not an app developer.

Tether

Ticker – USDT

Price (December 15th, 2019) – $1

Market Cap (December 15th, 2019) – $4,127,306,180

What is Tether?

Tether is a cryptocurrency designed to hold a stable value. One of the major criticisms on Bitcoin is that it is too unstable to be used as a currency. Bitcoin’s value can change by 20% during the course of a day. This scares away consumers. Stores are also reluctant to accept Bitcoins because they can lose value in just a few minutes.

Stablecoins were invented to overcome the price volatility. As the name suggests, stablecoins have a stable value and maintain a fixed exchange rate to a traditional currency such as USD, GBP, or EUR. Price stability makes them more suitable for transactions. Most stablecoins fix their value by having a reserve of actual cash matching the number of stablecoins in the market.

Tether is a stablecoin pegged to USD. It has a one-to-one exchange rate to US dollars. To achieve this peg, Tether maintains a cash reserve in USD. For each Tether in the market, there should be one dollar in the Tether reserve to match it.

The main difference between Bitcoin and Tether is stability. Thanks to its USD peg, Tether has a stable exchange rate. However, to fix the exchange rate, Tether must actively manage its cash reserve. Thus, it is not a fully decentralized and independent cryptocurrency like Bitcoin.

Binance Coin

Ticker – BNB

Price (December 15th, 2019) – $14.51

Market Cap (December 15th, 2019) – $2,256,818,342

What is Binance coin?

Binance coin is a cryptocurrency created by a popular cryptocurrency exchange, Binance. The Binance Cryptocurrency Exchange was founded in 2017. It allows investors to trade cryptocurrencies on its platform with advanced trading and order systems. For each transaction, Binance charges the user a transaction fee that can be paid with Binance’s own cryptocurrency – Binance coin. To drive the coin’s adoption, the exchange gives users a discount on transaction fees if they pay with Binance Coins. This incentive helps Binance coins gain popularity among cryptocurrency investors and traders.

Binance coins are useful if you use the Binance exchange. The discount can save you a fortune, especially if you are an active trader. Unfortunately, the discount it offers decreases each year, as shown in the schedule below.

| Trading Year | Transaction Fee Discount |

| Year One | 50% Discount |

| Year Two | 25% Discount |

| Year Three | 12.5% Discount |

| Year Four | 6.75% Discount |

| After Year Four | 0% Discount |

Binance coin is a good example of cryptocurrencies that are integrated into an ecosystem and created to service a particular network.

Categories of cryptocurrencies

These five cryptocurrencies are only some well-known examples of the promise and diversity of cryptocurrencies. As you can see, the world of crypto goes way beyond Bitcoin. There are currently more than 1,500 cryptocurrencies in the world, with new ones being created every day. Although it is impossible to explore them all, we can classify cryptocurrencies into five large categories to aid our understanding: digital currencies, Blockchain platforms, payment networks, stable coins, and other native currencies.

Digital currency

Digital currency is the most popular and foundational application of cryptocurrencies. They are used as digital cash. These cryptocurrencies offer a high level of security and can facilitate online transactions without a third-party. Bitcoin, Litecoin and Bitcoin Cash are notable examples of cryptocurrencies in this category.

Blockchain platform

Cryptocurrencies such as Ether are created to support blockchain applications. Developers run their applications on these blockchain platforms and pay for the services in cryptocurrencies. These currencies are not used in daily transactions. Instead, they are used to power blockchain applications and services within a blockchain network.

Payment network

Some cryptocurrencies are created to facilitate payment and currency exchange. These networks allow users to convert valuables and send money worldwide. They often use their own cryptocurrencies to help facilitate transactions and serve as an intermediary between exchanges. Ripple is the most well-known example of a payment network cryptocurrency.

Stable coins

Stable coins are cryptocurrencies with fixed exchange rates to traditional money. They are pegged to real currencies such as USD, GBP, or EUR. The peg helps them avoid price volatilities commonly associated with other cryptocurrencies. Notable examples include Tether, TruUSD, and Gemini Dollar.

Native currencies

Some cryptocurrencies are issued to pay for services within a network. These service providers issue their own native cryptocurrencies used to pay for activities such as trading, music download, and more. Often, using the native currencies gives the users a discount on the products and services. Examples of cryptocurrencies in this category include Binance coin, Tron, and Facebook Libra.

Cryptocurrency – not just money anymore

As the harbinger of cryptocurrencies, Bitcoin was the first safe and decentralized digital currency that caught the public’s attention. However, since then, the application of cryptocurrency has gone way beyond digital cash. While Ethereum is building a network of blockchain applications, Ripple challenges the global payment system with cheaper and faster payment solutions. Each cryptocurrency is unique with profound potentials.

As a result, these cryptocurrencies are bringing disruption to many industries and these changes are just the tip of the iceberg. While most people are only focused on Bitcoins, a good understanding of other cryptocurrencies can help you broaden your investment horizon and stay ahead of the game.