SPDR S&P 500 ETF Trust (SPY) is an index ETF built to replicate the performance of the S&P 500 stock index. With 276 billion dollars under its management, SPY is one of the largest and most liquid stock ETFs. Like common stocks, SPY is traded on the stock exchange. Instead of owning shares of a company, when you invest in SPY, you own a small portion of a portfolio designed to replicate the return of the S&P 500. As a result, your investment returns from SPY will resemble the return of the S&P 500.

As one of the most traded ETFs, SPY is very liquid and has a low expense ratio. The low cost and its close tracking of the S&P 500 make SPY a popular tool for investors to gain exposure to the equity market as a whole.

SPDR S&P 500 ETF Trust Quick Facts

- Ticker: SPY

- P/E Ratio: 17.13

- Net Asset under Management: $276 billion

- Gross Expense Ratio: 0.0945%

- (Source: State Street, June 24, 2020)

How does SPY work?

An index ETF is a fund designed to track the performance of a particular market index. In the case of SPY, its main goal is to track the performance of the S&P 500.

The managers of SPY achieve this by holding a portfolio that copies the composition of the S&P 500 as closely as possible. When stocks in the S&P 500 move during a trading day, SPY’s holdings will also experience the same movements and SPY will replicate the performance of the index. For example, when the S&P 500 goes up by 1%, SPY should also go up by 1%. The managers of SPY constantly rebalance SPY to make sure it matches the index consistently. SPY managers charge investors a percentage fee each year as compensation for their work.

Why invest in SPY?

Exchange-traded funds (ETFs) such as SPY offer many great benefits to investors. One of the most crucial advantages is the ability to replicate the return of a market index without owning every single stock in the index.

If you want to create a portfolio that tracks the S&P 500 without using an ETF, you would have to buy shares of all 500 stocks. Creating a portfolio like that is time-consuming and requires a lot of capital. On the other hand, SPY gives you the ability to track the S&P 500 by investing in one single ETF. You don’t have to worry about building or rebalancing the portfolio. Instead, it is all done by the ETF managers.

SPY also attracts investors who prefer passive investing to active management. Investing in SPY allows you to benefit from the growth of 500 blue-chip companies in the US without spending time on picking individual stocks. This is especially useful for buy-and-hold investors with a long-term investment horizon. Although investing in SPY doesn’t allow you to “beat” the market, it still offers attractive performance over the long-run.

SPY Historical Performance

Since the Great Recession of 2008, the stock market has experienced one of the longest boom cycles in history with an expansion that lasted 128 months. The performance of SPY is directly related to the overall performance of the stock market. As a result, SPY has performed extremely well by tracking the S&P 500 in the past decade. The average annual return from 2009 to 2019 for SPY was 14.99%. This 15% average return overshadows many actively managed hedge funds in the industry. Many investors switched from actively managed funds to SPY in the past decade as a result.

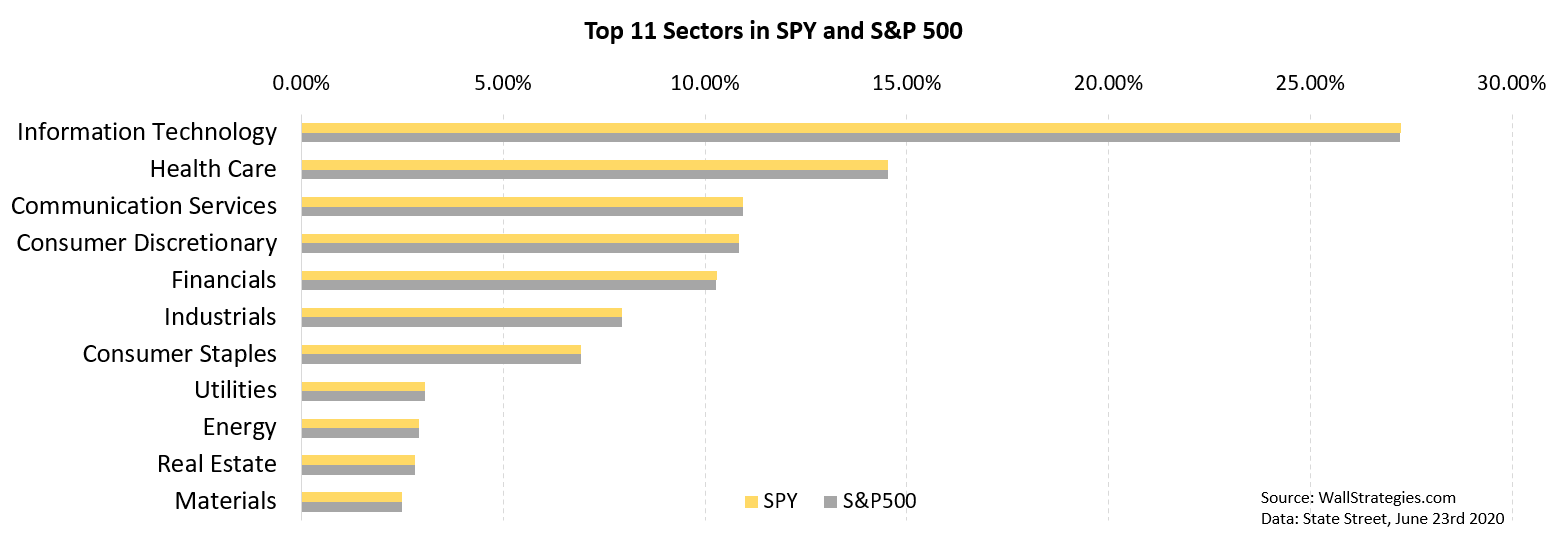

Top Sectors in SPY

Closely mimicking the composition of the S&P 500, SPY holds stocks in 11 different sectors with the top three sectors being information technology, healthcare, and communications. In the chart below, we are showing the compositions of the S&P 500 and SPY side by side. Because of its tech-focused composition, SPY tends to rise when stocks such as Microsoft and Amazon outperform.

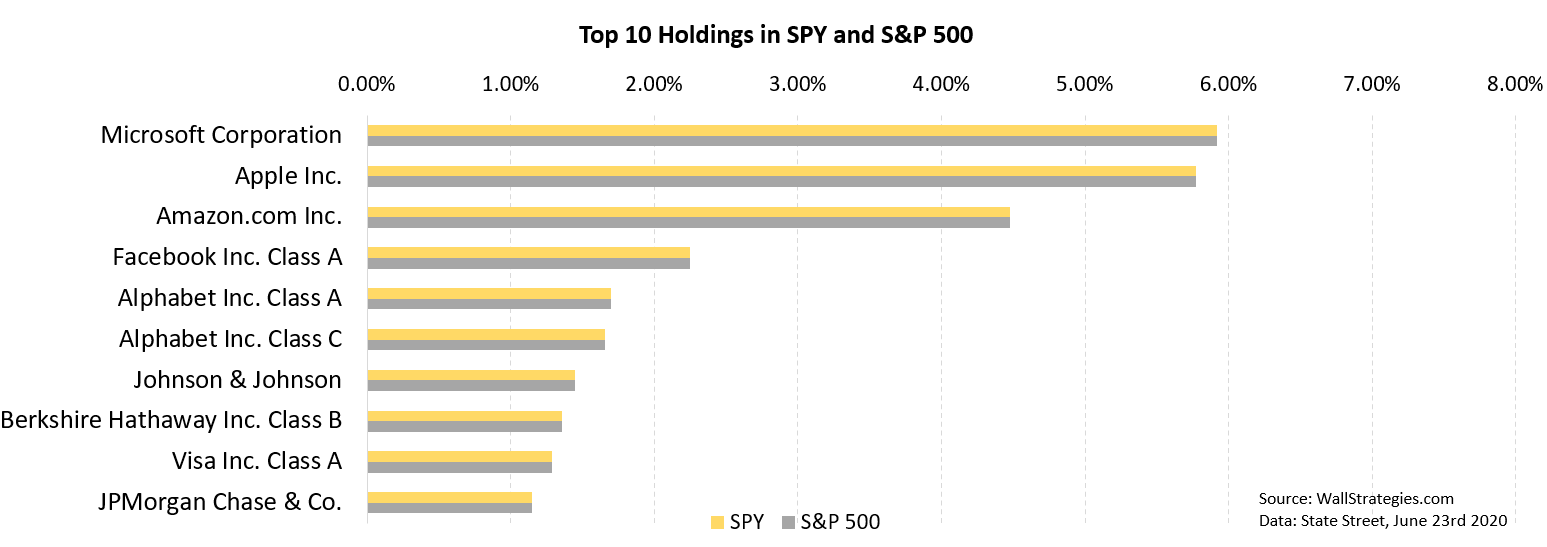

Top Holdings in SPY

SPY’s heavy focus on technology is more visible when we look at SPY’s top 10 holdings. The top six of SPY’s holdings are all in the technology sector. For instance, SPY’s stake in Microsoft represents nearly 6% of its portfolio. The rest of the top 10 holdings include three financial companies and one healthcare company. SPY’s heavy focus on companies such as Apple and Microsoft helps SPY gain record-breaking performance over the past decade when tech stocks posted strong growths.

SPY’s tracking error

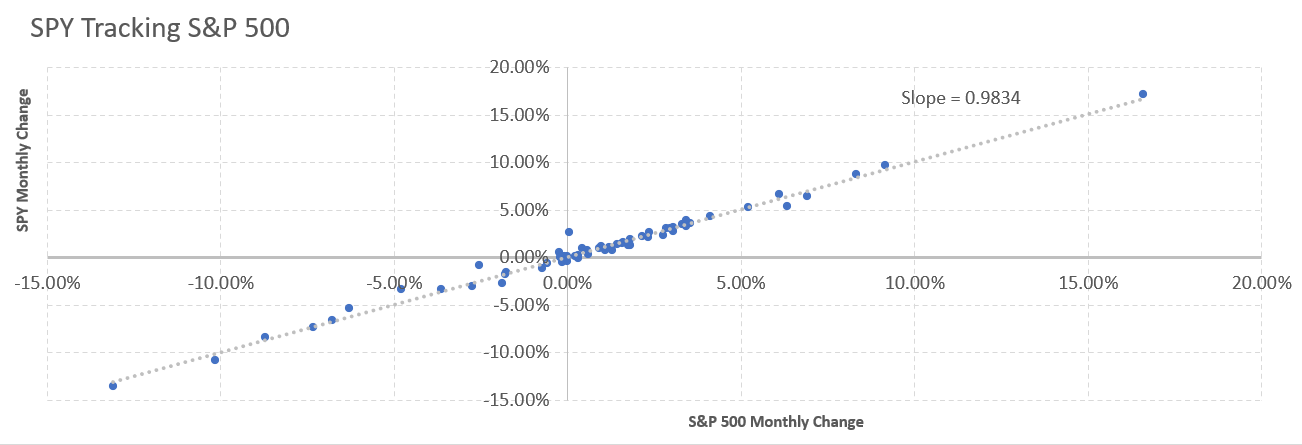

In an ideal world, SPY should replicate the performance of the index perfectly. However, the actual return of SPY can deviate slightly from the S&P 500. This deviation is called the tracking error of the ETF. In comparison to other funds, SPY has a low tracking error of 0.14.

To give a visual representation of SPY’s tracking precision, we plotted the monthly return of the S&P 500 and SPY for the past five years. A perfect tracking would have a slope of 1. With a long-term trend line slope of 0.9834, SPY tracks the S&P 500 closely.

Investors should keep in mind that lower a tracking error is always better. However, when investing for the long-run, the impact of tracking errors tends to disappear as deviations cancel each other out over time.