To real estate investors, the Tax Cuts and Jobs Act in 2017 presented an exciting investment opportunity through the Qualified Opportunity Zones (QOZs). The QOZs are areas in the U.S. in need of real estate development and investments that can stimulate the local economy.

To encourage investors to support real estate projects in the opportunity zones, the IRS offers significant tax benefits of capital gain tax deferral and reduction. The tax benefits are especially useful to investors who have profited from the equity and real estate boom in the past decade and are looking to reduce their capital gain tax burdens.

What are Qualified Opportunity Zones?

The Qualified Opportunity Zones, opportunity zones for short, are areas in need of real estate development that can bring jobs and investments into the neighborhoods. In 2017, the federal government announced substantial tax benefits on qualified investments in the QOZs to support the local economies.

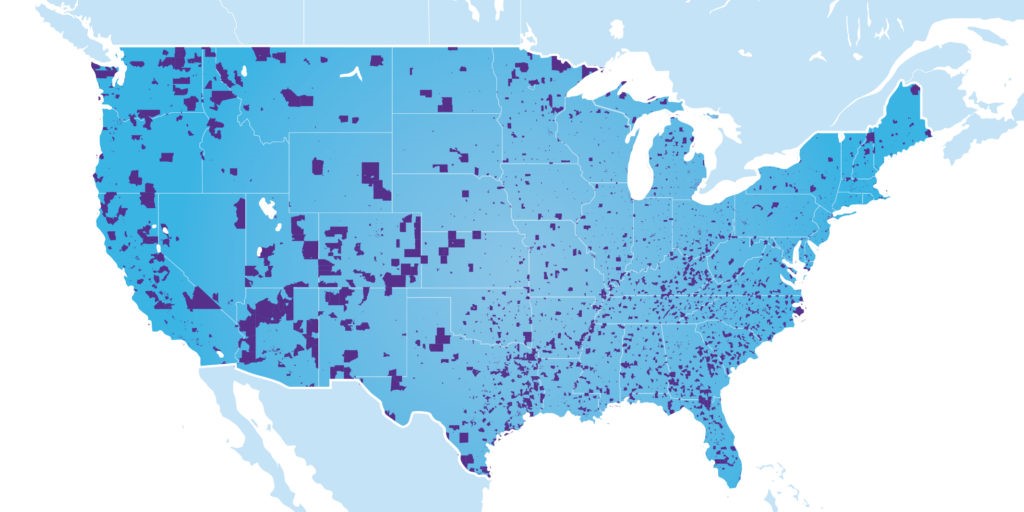

The QOZs were nominated by the state government and approved by the federal government. They are based on U.S. census tracts and scatter across different states with varying sizes and degrees of economic development. The map below shows all the opportunity zones in purple. You can also find the full list here.

Qualified Opportunity Zones – tax benefits

The biggest attraction of QOZ investments is the capital gain tax deferral and reduction. Both the stock market and the real estate market have gained substantial growth in the past decade. This created a large amount of unrealized capital gain in investors’ portfolios. The long-term capital gain tax rate can be as high as 20%. This deters investors from selling their investments.

For investors who have significant capital gains from their investments but don’t want to trigger a taxable event by selling, the opportunity zones offer a unique solution to first defer your capital gain taxes and further reduce it over time.

Capital gain tax deferral

The first benefit of QOZ investment is the capital gain tax deferral. Investors can defer their capital gain tax from stocks, bonds, or real estate investments until 2026 by rolling over the capital gain into an opportunity zone investment. To qualify for the deferral, investors must complete the rollover within 180 days of the sale.

The significance of this benefit is that it allows investors to defer tax payments until much later and use the tax dollars to generate additional return.

Given the long-term capital gain tax rates in 2020, tax deferral could increase your investing power by 15-20%.

Let’s further understand the benefits of tax deferral through an example. Let’s say you have $10,000 of capital gains and your long-term capital gain tax rate is 15%. When you sell your investment, you owe the IRS $1,500 in capital gain taxes this year. However, by rolling the $10,000 gains into an opportunity zone investment, you can defer the $1,500 tax payment and invest this money for additional return until 2026.

Tax deferral has a real monetary impact on your investment. Assuming a 6% growth rate, the deferred tax payment of $1,500 can grow to $2,255 in seven years. That’s an extra return of $755 just from the simple tax deferral! For investors with large capital gains, tax deferral can have an even bigger impact on their total return.

Capital gain tax reduction

In addition to allowing you to defer your capital gain tax payment, the IRS also reduces the amount of capital gain taxes you owe when you invest in the QOZs. For investment held for 5 years and more, investors can reduce their capital gain tax by 10%. After 7 years, investors can reduce their capital gain obligations by 15%.

| Investment Holding Period | Capital Gain Tax Reduction |

| Over five years | 10% |

| Over ten years | 15% |

Going back to our example above, with the tax deferral you can generate an extra $755 in investment return. Now with the tax reduction, the deal just got sweeter. If you hold the investment for 7 years till 2026, the original $1,500 you owe in capital gain taxes will decrease by 15% which equals $255. That’s $255 more in your pocket.

Zero capital gain tax

The last tax benefits of QOZs applies to future capital gains from QOZ investments. Tax deferral and reduction are benefits that apply to your existing capital gains. What about the capital gains generated from investing in the opportunity zones?

All capital gains from QOZ investments are tax-free if the investors hold the investments for at least 10 years. This benefit can be significant especially with large capital appreciation.

Let’s continue with our example. Assuming a 6% growth rate, in ten years, your original $10,000 will grow to become $17,908 in 2029. The best part is that the profit is free from any capital gain tax when you sell the investments.

How do I invest in Qualified Opportunity Zones?

With all three tax benefits, opportunity zones can be a powerful tool for investors with large unrealized capital gains and the intention to invest for the long-term. You might wonder how you can start investing in the opportunity zones. Based on the guidance from the IRS, investors cannot invest directly in opportunity zone properties. To gain the tax benefits, you must invest through a Qualified Opportunity Fund.

Qualified Opportunity Funds (QOFs)

Qualified Opportunity Funds are investment vehicles that pool investor money to invest in projects and properties in the opportunity zones. Through QOFs, investors can take advantage of the tax benefits that we have described above. Each fund has its own geographical focus and investment aim. To make sure the fund’s strategy aligns with your goals, investors should carefully review the fund documents before investing.

Where can I find qualified opportunity funds?

Opportunity zones are fairly new, so are opportunity funds. Despite how recent the policy was put in place, many funds have been formed to help investors access this market. You can find a directory of Qualified Opportunity Funds compiled by NCSHA here.

Who could benefit from Opportunity Zone investments?

The tax benefits offered by opportunity zones are useful in reducing both past and future capital gain taxes. While anyone can take advantage of them, this investment strategy is most powerful for these investors.

Investors with large unrealized capital gains

The first two of the opportunity zone tax benefits help investors with substantial capital gains the most. The equity and real estate growth after the Great Recession led to significant capital gains for many investors. The QOZs give these investors an option to exit their investments without triggering capital gain tax until 2026. By holding their investments in the QOZs, investors can further reduce their capital gain taxes.

Real estate investors with long investment horizons

For real estate investors with long investment horizons, the opportunity zones provide a tax-efficient way to invest. After holding the funds for 10 years, you will not be subject to any capital gain tax when selling your investments. For investments with high appreciation potentials, this tax saving can be substantial. Even if you don’t have any capital gain to roll into the opportunity funds, investing in opportunity zones might still be a good idea because regular real estate investments don’t provide this tax benefit.

Investment considerations

While the tax advantages of opportunity zone investments are attractive, the policy is still fairly new and there is no standard regulation for opportunity funds yet. Investors should stay cautious and do thorough research before investing.

Opportunity fund return

The tax advantages offered by opportunity funds are great but the actual performance of your fund is equally important to your profit. The return of opportunity funds varies and can be hard to predict. When the fund return is low, the tax advantages can be overshadowed and the investor might even be better off investing in other products.

Be aware of the fees

As with any fund product, opportunity funds charge investors fees for their services. However, because the funds are relatively new to the market, there is no standard fee structure. Investors need to pay a management fee, performance fee, property development fee and sometimes even more.

Complex and heavy fees can eat away your investment return. Thus, investors should speak to a salesperson or the fund to clarify the fee structure before investing.

Investment risks

Real estate investments can be risky. QOZ investments might carry more risks because the opportunity zones are economically distressed areas. These properties tend to carry higher risks.

Since the Qualified Opportunity Zones were only introduced in 2017, all opportunity funds have only been in business for a few years. This gives investors less historical data to analyze, making it harder to assess the risks associated with QOZ investments.

Conclusion

Opportunity zone investments are great options for investors to defer and reduce existing capital gains. Further, investors can also avoid future capital gain tax by holding their investments for more than 10 years. On the flip side, opportunity funds can be risky and the fees are higher than mutual funds and ETFs. The best way to optimize your QOZ investments is by researching each fund thoroughly. Cautious and rational decision-making will help you take advantage of the great benefits of the opportunity zones.