In July 2006, the Federal Reserve Bank of New York published a research paper on treasury yield curve inversion and its ability to predict an upcoming recession. At the time, the NY Fed predicted a nearly 30% chance of a recession in the following 12 months. In December 2007, the great recession hit and left many still recovering from its aftermath.

The yield curve inverted again in March 2019, sending alarming signals to investors around the globe. In July 2019, based on the yield curve inversion, the NY Fed predicted a 31.47% probability of a recession in the next 12 months. This raises the unsettling question- are we on the brink of another recession?

What is a yield curve?

Companies and governments often issue bonds with many maturities. Some bonds mature quickly while others will stay outstanding for decades. The US Treasury, for example, issues bonds with maturities ranging from a month to 30 years. When you plot bond yields along with their maturities, you have a yield curve like the one below. Thus, a yield curve is a curve that connects bond yields across different maturity dates for the same issuer. It shows investors how the yield changes with maturity for a bond issuer.

Why is the yield curve important?

When people talk about “the yield curve”, they are referring to the U.S. treasury curve specifically. Because treasury bonds represent risk-free investments, the U.S. Treasury yield curve is the risk-free yield curve and has been used to measure general sentiment towards the US economy.

The yield curve has a critical function as a leading economic indicator. It can help us predict where a country’s economy is headed. Historically, the shape of the yield curve is correlated to the business cycle. Prior to most recessions in U.S. history, there were warning signs from the shape of the yield curve.

What is a normal yield curve?

The government doesn’t set the yield curve. While monetary policies from central banks can affect the short-term interest rate, the yield curve reflects the market’s view on an economy through supply and demand. When more investors buy a bond, the yield on that bond will decrease. Conversely, if the demand is weak on a bond, the seller will need to increase the yield to attract buyers.

In the U.S., a normal yield curve has an upward slope, with the short-term interest rates lower than the long-term interest rates. As the maturity increases, the yield also rises.

The yield curve has a natural upward slope for several reasons. First, long-term investments have more risks than short-term investments. While the economy is unlikely to experience a lot of changes in one month, many things could happen for 30 years. To compensate for the higher risks, investors require more returns from long-term investments.

Additionally, an upward-sloping curve reflects the market’s view on the future interest rate and inflation. When you buy a long-term bond, the yield is fixed until maturity. If the 10-year bond has a 3% yield, you will receive 3% each year regardless of the current interest rate. Consequently, if you expect the interest rate to grow, you would require a higher interest from your long-term bonds than short-term bonds. The same principle applies to inflation. If you expect higher inflation in the future, you would require higher interest payments to cover the inflation for long-term investment. Thus, an upward-sloping yield curve shows that the market expects the interest rate and inflation to rise.

A normal yield curve is a sign of economic expansion. A growing economy often has high inflation. As a result, high inflation will lead the central banks to increase the interest rate in the future to prevent the economy from overheating. Consequently, an upward yield curve shows that most investors expect the economy to grow.

What is an inverted yield curve?

An inverted yield curve, on the other hand, is a less common phenomenon. When the yield curve inverts, the short-term interest rate is higher than the long-term interest rate. Investors are willing to accept a lower interest rate for a long-term investment. This willingness often reflects a worrisome outlook on the economy.

An inverted yield curve reflects investors’ views on inflation and interest rate. It shows that the investors are expecting lower interest rates and lower inflation in the future, which are both signs of an economic slowdown. With such expectations, they are more willing to accept a lower long-term rate now.

Yield curve inversion also signals the market’s perception of risks. Because the US treasury represents the risk-free investment, investors tend to move their money into treasuries when they want to reduce the risks in their portfolios. This increased demand suppresses the bond yield. When investors are concerned over the long-term economy, they are more likely to sell risky investments and put the money into long-term treasuries. This causes the long-term yield to drop and inverts the yield curve.

The inverted yield curve and recession

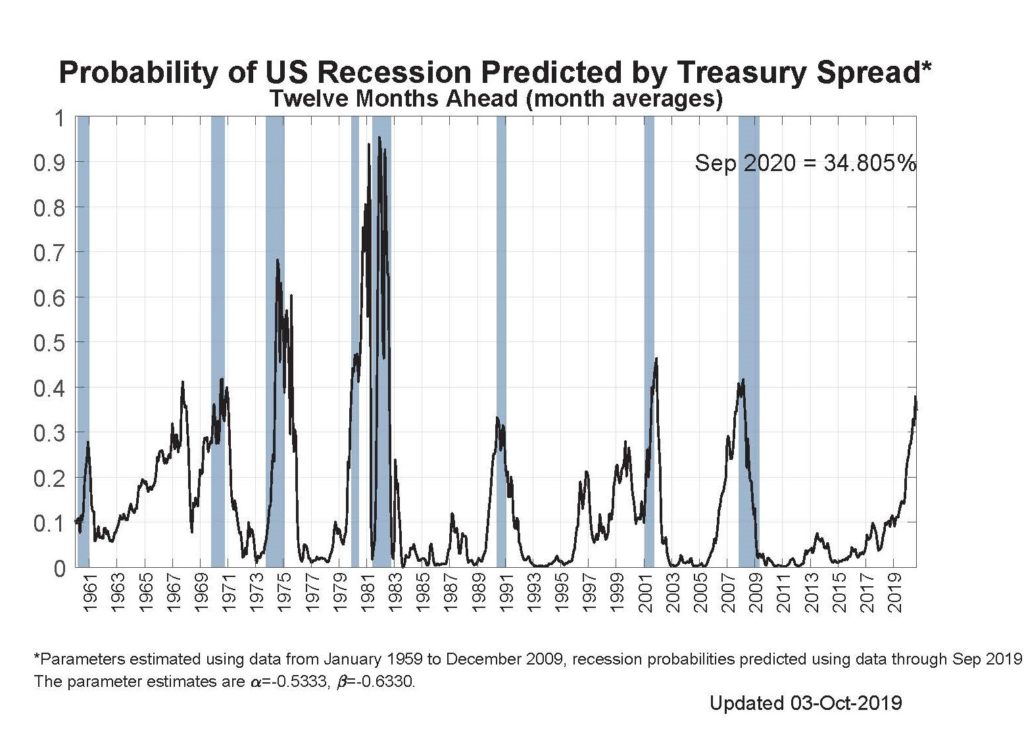

The inverted yield curve has been an accurate indicator of recessions. Before the Great Recession, the yield curve was inverted in August 2006, signaling an upcoming recession. In fact, yield curve inversion foreshadowed all previous six recessions, as illustrated by the chart below.

The following chart produced by the NY Fed shows the spread between the 10-yr treasury bond and the 3-month treasury bond on the vertical axis. Normally, the spread should be positive as the 10yr yield is higher than the 3-month yield. Months before each recession shaded in gray, the spread would become negative as a result of the yield curve inversion.

The yield curve’s global nature contributes to its predictive power. The US treasury is popular not only with American inventors but investors and central banks around the world. Consequently, the inverted yield curve reflects the global outlook on the US economy.

Are we heading to a recession now?

In March 2019, the US yield curve inverted for the first time since the Great Recession of 2008. The inversion alarmed investors around the world. Further, based on the inversion, in September the NY Fed has predicted that there is a 34.805% probability that we will experience a recession by September 2020. Based on the yield curve, a recession seems likely.

What is a recession like?

The academic definition of a recession is a reduction in GDP for two or more consecutive quarters. In practice, a recession is a general halt or slowdown of economic activities and prosperity. During a recession, businesses stop growing and might even suffer losses. This then leads to restructuring and layoffs. A higher employment rate further lowers demand and business profits.

What should I do?

While it is crucial to understand the leading indicators and prepare for a recession, panic is never a good idea. Recessions are inevitable parts of the economy and our lives. The cycle of boom and bust are normal and essential to a functioning economy. Prior to a recession, there are steps you can take to better prepare for it and strengthen your finances.

Set up an emergency fund

It is a good idea to have an emergency fund available to you at all times. Normally, the fund should be sufficient to cover your expenses for 6 months. If you don’t have enough saved up, it might be a good idea to increase your monthly savings now. If you are looking for a safe investment for your emergency fund, certificates of deposits could be a good option for you. You can read more about them in this article.

Think twice before quitting your job

If you plan on quitting your job, you should be extra careful with such decisions ahead of a recession. During an economic slowdown, companies hesitate to hire new employees. Unless you have another job waiting for you, it might just be a good idea to stay put for now. Staying on your current job will give you more income to help you deal with the uncertainties.

Get a side hustle

Unemployment rises during a recession. It helps to diversify your income streams ahead of it. Thanks to the internet and global connectivity, there are more ways to make money online than ever. You can sell your artworks online or open an e-commerce shop. The cash you bring in is extra security to you and your family

Pay off your debt

Paying off debt should be a priority in any economic environment. Debt and interest payments can add pressure on your finances, especially during a recession. If you can, try to pay off your debt more aggressively. This will help reduce your burden when things are not going perfectly.

Diversify your portfolio

Equity investment often suffers during a recession, as companies struggle to grow. Consequently, to prepare for a recession, diversification is critical. If you have a lot of concentration in one stock, you should consider diversifying it with companies that are robust and healthy. Additionally, if you fear that your current portfolio might be too risky, speak to your investment advisor to reduce the risk with bonds and other low-risk investments.

Keep investing and living life

Life carries on even when the economic growth stops. It is crucial for you to stay engaged in things that keep you happy and relaxed. This will help you deal with the stresses better. Additionally, you should keep an eye on your long-term financial goal and continue investing and saving. This will help you stay on track for your financial future.

Bonus material: inverted yield curve and Quantitative Easing

Some researchers argue that the yield curve has become less predictive because of the Quantitative Easing (QE) program. QE was a new monetary policy tool adopted by the American and European central banks to fight the Great Recession in 2008. In the QE program, the central banks purchase a large amount of long-term debts on a monthly basis. The large demand from central banks artificially reduces the long-term bond yield. Consequently, QE disrupted the long-term bond market and some argue that the yield curve is less predictive as a recession indicator because of it.

However, QE is a new policy tool used for the first time in 2008. Because of its complexity and novelty, it is hard to quantify exactly how QE has impacted the yield curve. As policymakers and central bankers further explore the full impact of QE, investors should continue monitoring the signals from the yield curve to prepare for a potential recession.