TSLA is without a doubt one of the most exciting stocks of 2020. From its 400% appreciation to the recent stock split, investors can’t stop talking about Tesla. Despite the recent selloff, investors are once again piling into TSLA stocks, pushing the price higher. But should you invest in TSLA? And most importantly, can Tesla stocks go up another 400%?

TSLA bull factors

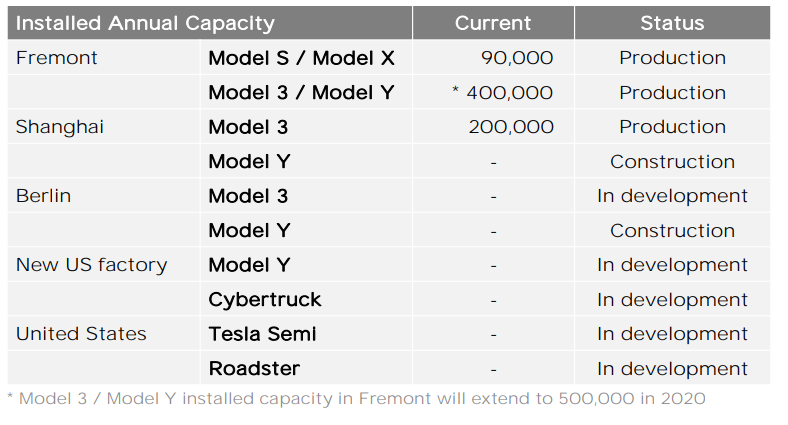

Tesla’s growing production capacity

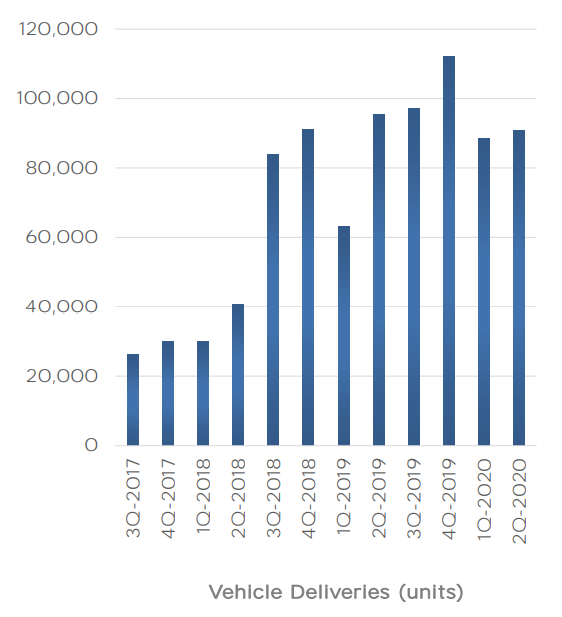

One of the challenges with Tesla has always been its limited production capacity and delivery. Selling cars has never been a problem for Tesla but the company has struggled with slow production in the past. Waitlists and delivery delays are not uncommon for Tesla customers. However, in 2020, the company is showing a renewed production vigor with growing capacity.

One of the key drivers for TSLA stock’s insane bull ride is its steady car production during the 2020 pandemic. Despite the Coronavirus disruption, Tesla did not suffer a major drop in production. When compared to last year, Tesla’s vehicle delivery remained strong during a global pandemic that disrupted supply chains and halted productions for many carmakers.

Looking ahead, Tesla is building new Gigafactories in Shanghai and Berlin. Just the Berlin Gigafactory alone will produce 500 thousand cars per year. These new factories will allow the company to ramp up its production to an unprecedented scale and finally push its cars to the broader market. At the same time, Tesla’s Shanghai factory will directly service the Chinese market and meet the growing demand from Chinese consumers.

Tesla is making money

Tesla reported a net income of $68 and $129 million respectively for the first and second quarters of 2020. While the company was also profitable in the second half of 2019, Tesla has never made an annual profit. The convincing performance from the first half of 2020 sets Tesla up for its first profitable year. This will be a meaningful milestone for Tesla and its investor base.

What’s more promising is TSLA’s increasing gross margin. Gross margin measures revenue against the cost of goods and production. Tesla’s increasing gross margin shows that the company has been lowering the cost of production, even during the 2020 pandemic.

| Tesla Profitability | Q2 2019 | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 |

| Automotive Gross Margin | 19% | 23% | 23% | 26% | 25% |

| Total GAAP gross margin | 15% | 19% | 19% | 21% | 21% |

| Net Margin | -6% | 2% | 2% | 1% | 2% |

At the same time, costs associated with COVID has resulted in a lower net margin for Tesla in the first two quarters. But we expect the net margin to bounce back after the pandemic, as a result of TSLA’s continued cost-cutting measures.

Tesla – the dominator of batteries and more

We used to think of Tesla as an electric carmaker but that label is becoming less and less accurate. TSLA’s business revenue is becoming increasingly diversified. When we look at the company’s business segments, it’s easy to see that Tesla is morphing into an energy innovator. The three main revenue segments for Tesla include:

- automotive

- energy generation and storage

- services and other revenues.

While the company’s car production is often the focal point, Tesla’s energy business continues to grow despite the weakness in Q1 as a result of the Coronavirus crisis.

| Tesla Revenue Growth | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 |

| Automotive Sales | -0.70% | 19.70% | -20.35% | 0.37% |

| Automotive Leasing | 6.25% | 1.81% | 6.22% | 12.13% |

| Energy Generation and Storage | 8.94% | 8.46% | -32.80% | 26.28% |

| Services and Others | -9.42% | 5.84% | -3.45% | -13.04% |

Tesla’s energy business includes both energy storage and generation. With fossil fuel gradually losing traction among consumers, businesses and homes will demand more and more batteries to store electricity generated through sustainable sources such as wind or solar. Tesla is the leader in battery technology and this segment has a lot of potentials to grow.

Tesla’s Solarglass roof solves the dilemma between functionality and form. Traditional solar panels are intrusive and often face backlash from homeowners who value aesthetics. On the other hand, TSLA’s Solarglass blends in just like regular roof panels and it can capture solar energy to reduce your electricity bills.

TSLA bear factors

TSLA’s valuation is too high

One of the major arguments against TSLA stock is that the stock price is too high. The company’s current price to earnings ratio (PE ratio) is around 1,100. To put it in context, Apple’s PE ratio is around 25 and Amazon’s PE is around 110. This PE ratio is even more over-the-top when we compare it to that of other carmakers. For example, General Motors’ PE is around 28 and Nissan’s PE ratio is around 3.

A high PE ratio means that investors are paying a lot of money for each dollar in earnings generated by TSLA. One justification for a high PE is growth. If investors expect a company to grow, they might be willing to pay a higher price for a stock because they expect the PE ratio to decrease after the earnings goes up. In the case of TSLA, the company’s supporters justify the high valuation based on the company’s dominance in the EV market and growth potential.

However, even when accounting for growth, TSLA’s current stock price is still expensive. Using Tesla’s current stock price (September 21st, 2020) and the company’s revenue in the first half of 2020, we can calculate how many times the revenue must grow for TSLA’s PE ratio to reach a reasonable level.

| Target PE Ratio | 50 | 100 | 200 |

| Stock Price | 440 | 440 | 440 |

| Revenue Needed | 404,268,258,977 | 202,134,129,488 | 101,067,064,744 |

| Revenue Needed/ 2020 Revenue | 16.82 | 8.41 | 4.20 |

For each PE ratio, we calculated the revenue required based on TSLA’s net margin in Q2 2020. Then, we divided the revenue needed by the company’s expected revenue in 2020. The last row shows how much the company’s revenue must grow to reach each target PE ratio.

For example, to reach a 200 PE ratio at the current stock price, TSLA must quadruple its revenue. And for TSLA to reach a 50 PE ratio, the company must grow by 16 folds. Even if we expect a better net margin as a result of TSLA’s increasing economy of scale, the current stock price still requires the company to produce way more cars than its capacity allows. The elevated price of TSLA stocks creates a lot of headwinds for further appreciation.

Increasing competition

One cannot deny Tesla’s leading position in the electric vehicle market. TSLA’s advantages go beyond technological advancements. The company’s design prowess and its powerhouse leader, Elon Musk, have built a brand that consumers see as a yardstick for EVs. TSLA’s intangible assets are tremendous.

However, the company’s leading position can also be vulnerable in the long run. Seeing the potentials of electric vehicles, many companies are now developing their own EV technologies and hybrid cars. Tesla’s competitors include

- traditional carmaker giants such as Ford and GM

- luxury carmakers Porsche and BMW

- EV startups – Li Auto and Nio

Each one of these competitors brings something unique to the table. For example, Porsche and BMW dominate in the luxury space while Chinese startups such as Nio are offering extremely affordable EV options to a large and cost-conscious market. Increasing competition can put downward pressure on TSLA’s revenue and market share growth, making the current stock price even harder to justify.

TSLA stock upcoming catalyst – Battery Day

Tesla’s Battery Day is likely to spark new volatilities for TSLA stocks. Tesla’s CEO Elon Musk has promised that the company’s Battery Day event on September 22nd will be mind-blowing. We are expecting news on a few technologies and company developments including the company’s own battery production, million-mile batteries, and dry battery technology.

With the hype around Battery Day, this event could be the next inflection point for Tesla stocks. Depending on the technology unveiled, TSLA stocks could go higher from its current price level. But one thing we know for sure is that Battery Day will create even more volatility for TSLA stocks in the future.

Should I invest in TSLA stocks?

Tesla is a great company with competitive products and capable management. The company has a lot of potential to revolutionize the auto industry and even the energy sector. Yet, when we weigh the growth potential against the stock price, it is easy to see that TSLA stock will struggle to replicate its 400% growth, given its current capacity.

While investors can debate the company’s potentials, the current price level would require a much stronger revenue that could take years and even decades to achieve.