Apple (AAPL) investors are expecting a stock split on August 31st, 2020. Each share of AAPL stock will be split into 4 shares. Many investors holding AAPL stocks might be wondering how the stock split will affect their investments. In this article, we will help illustrate what a stock split is and how it might affect AAPL stock pricing going forward.

What is a stock split?

A stock split is a corporate event that increases the number of shares outstanding by splitting individual shares into multiple new shares. For example, Apple’s 4-to-1 stock split will divide every single share into 4 new shares. If you own 100 shares of AAPL now, you will have 400 shares after the split on August 31st.

While the number of shares outstanding increases after a stock split, the stock price will be adjusted downward to keep the company’s total value (market capitalization) constant. The stock price will be divided by the split ratio accordingly. A $400 stock will become 4 shares of $100 stock. Consequently, the value of your AAPL stocks will stay the same after the stock split.

Why do stocks split?

Since stock splits do not affect the company’s valuation directly, why would companies go through the troubles to divide their shares? It turns out stock splits have a few benefits to the company and investors.

The main driver for stock splits is to reduce the share prices. High stock prices can prevent smaller investors from buying the stock and limit its liquidity. A reduced share price allows more investors who previously were not able to purchase the stocks to invest in the company. Effectively, a stock split makes the stocks more affordable and thus broaden the investor base. This, in turn, can boost the demand for the stock and thus lift share prices.

Psychologically, stock splits make stocks appear cheaper. As we discussed above, a stock split doesn’t change the actual valuation of the company. It also doesn’t affect the dividends you are entitled to. However, a lower price tag makes the stock appear cheaper and thus more attractive to some investors.

Stock splits also boost the liquidity for a stock. Expensive stocks are like 100-dollar bills. They are valuable but not easy to use especially for small transactions. Cheaper stocks make trading a small amount easier and can improve the liquidity and health of the AAPL stock market.

AAPL stock split history

This is not Apple’s first stock split. As one of the fastest-growing tech companies in the world, Apple has conducted four stock splits before this upcoming split. Here is the complete history of AAPL stock splits in the past.

- June 16th, 1987 – 2 for 1 stock split

- June 21st, 2000 – 2 for 1 stock split

- February 28th, 2005 – 2 for 1 stock split

- June 9th, 2014 – 7 for 1 stock split

- August 31st, 2020 – 4 for 1 stock split

How will the stock split affect AAPL stock price?

Even though stock splits can appear to be a mere accounting exercise, a well-timed split can have a meaningful impact on the share price of Apple as a result of the benefits discussed above.

Short-term impact

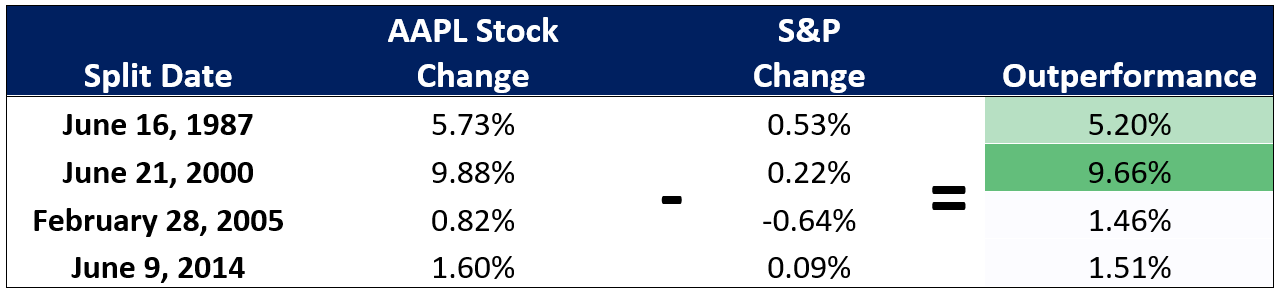

Stock splits for Apple have historically given AAPL a price boost, especially on the day of the split. To understand how a stock split can affect share price, we need to look at the daily performance of AAPL stock on the past four stock split dates. To provide more context, we also included the daily performance of the S&P 500.

(Data Source: Yahoo Finance)

The historical data shows that a stock split is a positive event on the stock price on the day of the split for Apple. All past four AAPL stock splits were received with positive price actions and helped the stock outperform the S&P 500 stock index. Based on historical evidence, we can expect a similar rally for AAPL stock on August 31st as the split provides a nice momentum for Apple.

Long-term impact

The direct price impact from stock splits is most pronounced around the split dates. In the long-term, stock splits are less impactful on share prices than other fundamentals such as company earnings, management decisions, and competitive outlook.

Yet, the stock split can be seen as a positive signal from the company. On one hand, it is the result of recent growth that pushed AAPL stocks to record highs. On the other hand, a stock split suggests that Apple’s management is expecting further price growth for the stock. Lastly, a split also creates headroom for AAPL stock to continue its growth in the long-run.