Frankly, 2020 has been a really tough year for investors so far. With billions of people staying home, businesses are fighting to simply avoid bankruptcy. In March, the Coronavirus led financial markets around the world to fell into bear market territory. In the US, the Dow and the S&P suffered the most devastating declines since 1987.

The bitter tastes of the Coronavirus crash left many investors scared to invest their money. The important question is – how often does the market actually crash? And should you let the fear of market crashes prevent you from investing?

So, what is a market crash?

Market crashes are like pornography. While they are hard to define, you will know it when you see one. Although there is no consensus definition of a market crash, it generally describes a quick decline in stock prices and it can be really painful.

We define a market crash as a daily decline greater than -5% in a market index such as the Dow or the S&P. Stock indices are made of many different stocks. They represent the market well and are normally stable due to their diversification. However, when a market index drops by 5% or more, something is seriously wrong in the market.

How did the Coronavirus crash the market?

The way the Coronavirus crashed the stock market is best described as throwing a wrench into a roaring machine. In order to contain the spread of COVID-19, governments are forced to implement travel bans and quarantine. All of a sudden, the world economy ground to a halt. Factories shut down, leading to supply chain disruptions. Lower demand for oil also sent crude price down the drain, causing turmoil in the energy sector. Airlines are flying empty aircraft and hemorrhaging money.

On the demand side, the shutdown means that consumers are not spending as much money as they did before. People are trapped indoors instead of dining at their favorite restaurants. At the same time, concerns over the economy lowered consumer confidence. Fearing a recession and suffering devastating job losses, consumers have less money to spend and are more careful with their expenses.

All of these resulted in a series of market crashes so bad that they caused the S&P to fall in bear territory in merely weeks. The worst crash happened on March 16th when the S&P declined by 12% in just one day, erasing the gains from the previous bull market.

But how often does the market crash?

The Coronavirus market crash was the worst selloff we have seen in a long time. The crash was so fast and damaging, it scarred many investors and prevented them from investing in the market soon. While the Coronavirus market crash reminded us of the risk of investing, we also need to put the risk into perspective, with data!

We compiled the daily price change of the S&P index from the beginning of 1928 to March 2020. That’s 92 years of daily trading data. With this data, we can understand how often the market actually crashes.

Out of over 20,000 trading days in the past 92 years, there were 85 days when the S&P declined by over 5%. Statistically, that’s only 0.4% out of all trading days, quite uncommon. We also checked how many times the market crashed by more than 10%, as it did on March 16th. The data shows that market crashes like the one caused by the Coronavirus (12% daily drop) are so rare that there were only 3 other days like it in the past 92 years. On average, a crash like the one caused by the Coronavirus on March 16th only happens once every 23 years.

| Daily Change (%) | -5% | -10% | -15% | -20% |

| Frequency | 85 | 4 | 1 | 1 |

So the good news is that as much as crashes are hard to bear, they are fortunately rather rare events. However, this is not to say that there is no risk. Market crashes are not necessarily evenly distributed. There could be multiple days of market declines in a row that could be really devastating.

Why should I still invest?

Although we don’t know when the next crash will happen, we can promise you that when you invest in the market you will experience at least one market crash in your lifetime. That doesn’t sound comforting. So should you still invest your money?

Here comes the good news we want to share with you. Although crashes can take a toll on your savings, statistics show that your investment is more like to grow in the long run. Here is why.

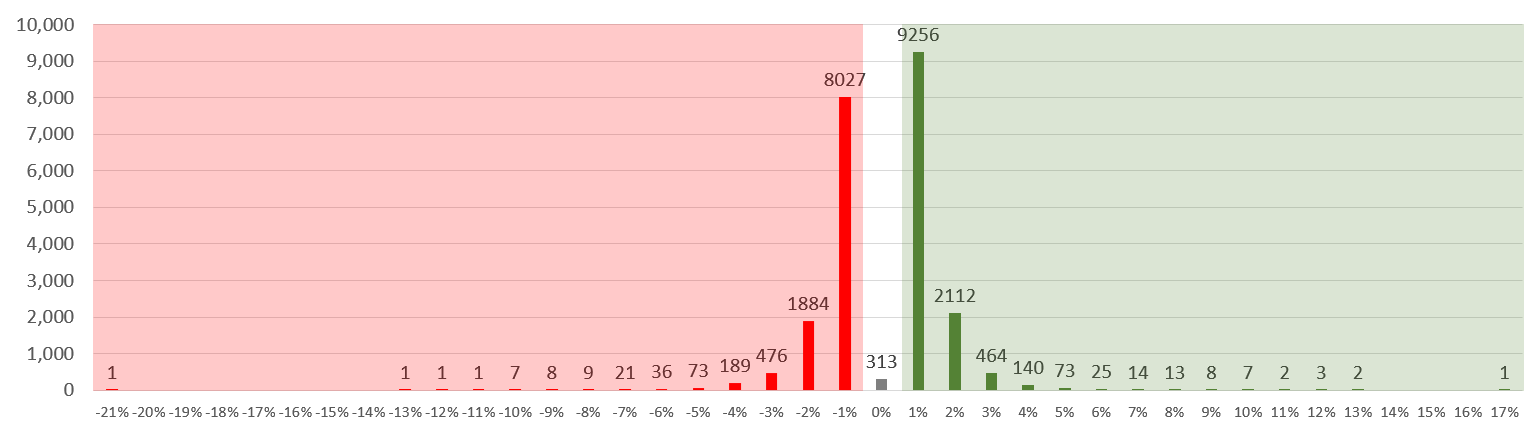

With data on the daily percentage change in the S&P, we wanted to know how often the market closed with a gain or a loss. To do that, we grouped these daily changes into buckets and plotted their frequency in the graph below. On the horizontal axis, we have the daily percentage changes in the S&P. For example, 1% represents all the daily changes between 0 and 1% while -1% represents movements between -1% and 0%. On the vertical axis, the bars represent how many times the S&P had a daily change that falls within this range.

This chart allows us to see the frequency of different daily performances in the S&P. Here are a few very interesting observations. First, extreme market selloffs are bigger than extreme market gains. The largest decline in the S&P was -20.5% while the biggest daily gain was only 16.6%. This means that when the market goes down, the fall is faster and more extreme than extreme market rallies.

However, the second observation is that given any trading day the S&P is more likely to have a gain than a loss. As you can see in the chart, the green bars in the positive territory are higher than their red counterparts representing losses. Statistically, there were 12,120 days in the past 92 years where the S&P recorded a gain. On the other hand, the S&P recorded a loss for only 10,734 days. This means the S&P is 1.13 times more likely to have a gain than a loss on any given trading day.

Combining these two observations, the data shows that market declines are often more drastic than market gains. But the market is more likely to grow than decline on any given day, thus accumulating small gains over time. These two observations support the tested wisdom that investing is great for you in the long run. Although market crashes are powerful and intimidating, investors accrue small daily growths from their investments over time that outweigh market crashes and build wealth. And the data supports that.

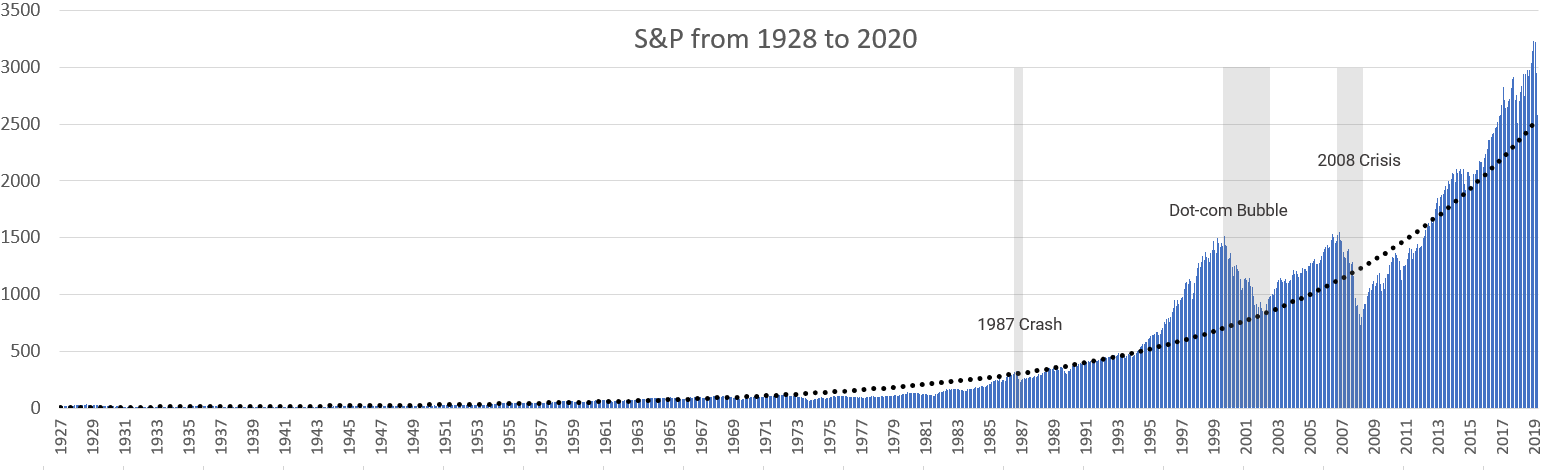

Looking at the historical performance of the S&P, you will notice that the slopes of the upward trends are less steep than the slopes of the downward movements. This reflects the first observation that selloffs are bigger in magnitude than rallies. However, although the slope of the growth is flatter, bull markets cover a longer period and eventually outweigh the impact of the crashes over time.

During a crisis, it is easy to feel hopeless but it’s important to remind yourself that this too shall pass. No matter how bad the market crash is, the market has always recovered. In the chart above, the highlighted areas show a few market crashes in recent years. In the long run, even the worst crises such as the 2008 financial crisis are only a bump on your investment journey. When you invest with careful research, your investment will grow over time and help you build your wealth.

What to do when the market crashes?

The worst thing you can do during a crash is panicking. Panic selling often leads investors to lock in huge losses and miss out on the recovery that follows later. It’s critical in a crisis to stay calm and not make impulsive decisions. With a clear mind, you can analyze the situation better and make more informed decisions.

Moreover, many investors view market crashes as opportunities to buy undervalued stocks. The truth is that in a long bull market many stocks are overvalued. A market crash can get rid of the bubbles in the market and create buying opportunities. However, market volatility is often high after a crash. The price of stocks will continue to fluctuate wildly in both directions. Right now, the stock market is 6 times more volatile than before the Coronavirus crash. This means that it is impossible to time your investment perfectly and the risk of entering the market at the wrong time is high. In a market like this, dollar cost averaging stands out as a useful investment strategy to reduce timing risk and help you stay on track.

Lastly, not every cheap stock is worth buying. There is a term called “catching the falling knives”. It describes buying stocks before it fully reaches the bottom. Market crashes create buying opportunities but a careful selection process is needed for you to distinguish opportunities from falling knives.