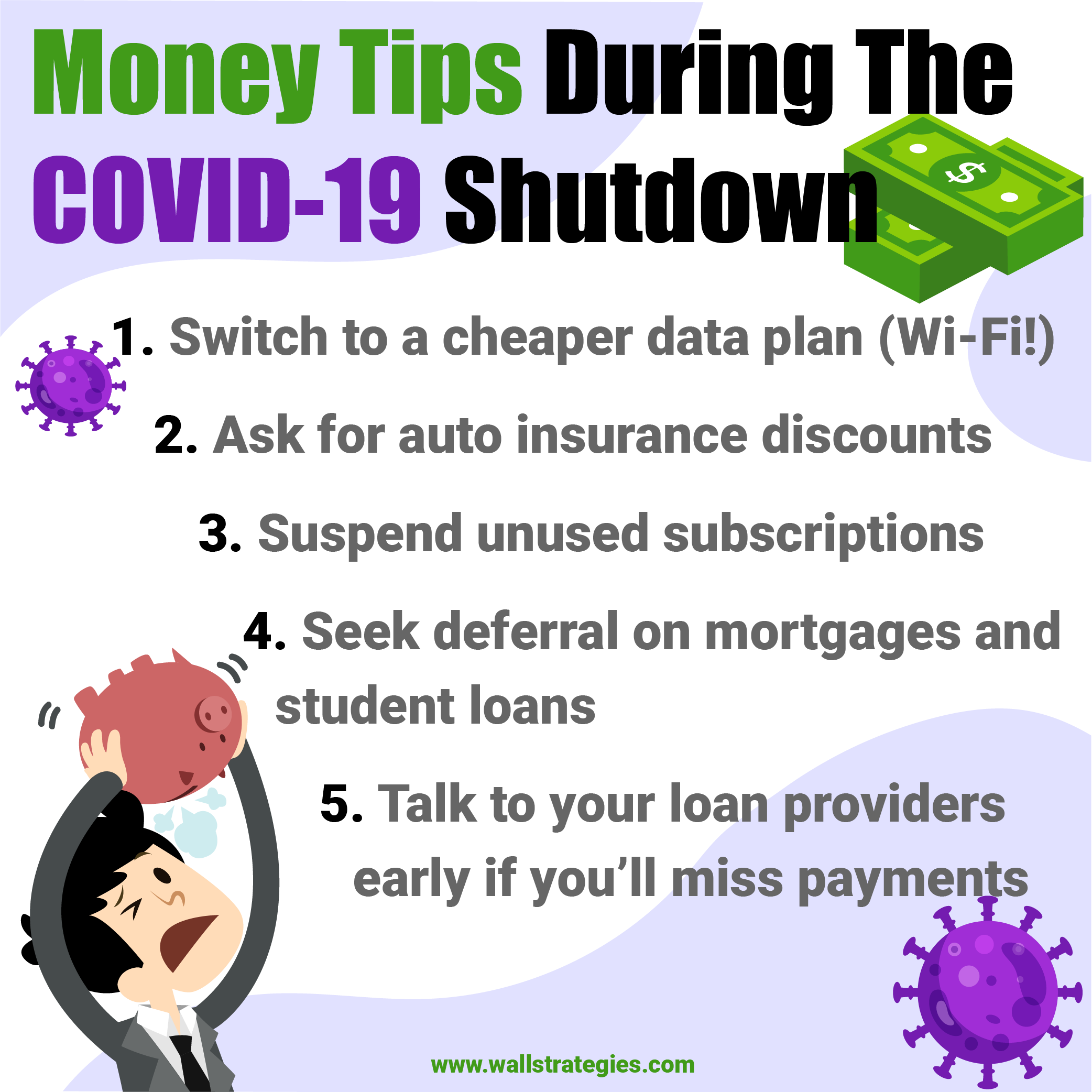

One month into the Coronavirus crisis, it’s still unclear when our normal life would return. At the same time, the virus has put heavy financial burdens on working families around the world. With millions out of work and without pay, money has become increasingly tight.

The money challenge will only grow bigger the longer we remain shut down. While you are stuck at home, here are six things you can do now to cut your expenses and relief your debt burdens during this crisis.

Ask for A Discount on Your Insurance Premium

With businesses shut down, people are not driving as much. Less commute not only reduces your risk of getting into car accidents but also your auto insurance premium. Many insurance companies are offering Coronavirus refunds on their auto insurance policies. For example, Farmers Insurance is cutting their auto insurance premium by 25%. If your insurance company didn’t offer you a discount, call them up right now and ask for a premium reduction. This is a saving that you deserve.

Suspend or Cancel Gym and Exercise Memberships

Gyms and exercise studios are closed across the country. However, some gyms are still charging their users membership fees, most likely by accident. If you have a gym membership, it’s time to check if you are still being charged while the business is shut down. If so, contact the gym immediately for a refund and suspend your membership.

The same applies to exercise studios. You might already have been charged for March. If so, contact them to extend your classes to after the shutdown. Make sure you watch your bank statements closely so you are not charged for other services you can’t use right now such as co-working space and transportation cards.

Switch Data Plans

Data junkies are finding themselves using a lot less mobile data during the Coronavirus shutdown. This is good news if you frequently exceed your data limit. With most of us staying home and using only Wi-Fi, it might be a good idea to switch your data plan to the cheaper options. Mobile data is expensive and most plans don’t offer rollover options. Why should you be paying for expensive data that you are not using? Switching your data plan might just save you enough money to cover other more important expenses.

Defer Mortgage Payments

Mortgage payments are a big expense item that many are losing sleep over during this crisis. Paying for your mortgage can be difficult during the shutdown but missing a payment has serious consequences. If you think you will miss an upcoming mortgage payment, call your bank up right now and discuss a deferral option. Many countries such as the U.S. and Canada have passed stimulus bills to help relieve mortgage payment stress. If you are struggling financially, make sure you use this option to take the pressure off until after the lockdown.

Federally backed mortgages

If your mortgage is backed by a federal agency such as Fannie Mae and Freddie Mae and you recently lost your job because of COVID-19, you can postpone your payments for up to 180 days without penalties. However, you must work with your loan provider to suspend the payments.

Mortgages held by banks

If your mortgages are owned by a bank, the terms of relief will depend on the bank you work with and the kind of mortgage you have. Most banks are offering mortgage payment suspension to their customers who are experiencing financial hardship due to COVID-19. However, each bank has its own policies and terms. Reach out to your bank to find out what they can do to help you avoid missing your payments.

Student Loan Relief

Recent graduates are among the most hard-hit groups during the Coronavirus crisis. While their careers are put on hold due to the economic shutdown and upcoming recession, they also have heavy student loans to repay.

As part of the stimulus package, all federal student loans are suspended until September and all interests are waived. This means that if you continue to make student loan payments, all the money you pay will be used to reduce your principal. If you have a private student loan, contact your loan provider to ask for a suspension or assistance. This can help you reduce expenses during the shutdown.

Don’t be Afraid to Ask

The last tip we want to share is don’t be afraid to ask for help. The Coronavirus has impacted billions of lives across the world and many people are struggling to pay their bills. You are not alone. Businesses and governments have put in place Coronavirus relief policies to support you. This applies to rent, bill payments, and loans. What you need to do is to ASK for help and support if you are struggling. Some of these policies require you to say that you have been impacted by COVID-19 explicitly so make sure to mention it in your request when asking for help.

However, you have to ask for help early. Don’t wait until you miss a payment to reach out. Companies are more likely to offer you better options and support before the deadline. Also, reaching out early prevents the negative credit impact a late payment might have on your credit score. So our advice is to do a quick overview of the upcoming bills so you can plan early and come up with solutions.