In March 2000, the dot-com bubble officially reached its peak, bringing the Nasdaq index above 5,000. Only five years ago, the stock index was trading around 800 points. Thanks to the frenzy over tech stocks and the turn-of-the-century optimism, investors had no fear throwing their money into the market right before a painful bust. Fast track to 20 years later, we find ourselves once again in a frantic bull market led by tech stocks such as Apple, Tesla, and Amazon. Cautious investors begin to once again wonder if we are in the middle of another tech stock bubble.

The first golden age of technology stocks – 1995-2000

Before the burst of the dot-com bubble, the US stock market had a spectacular run from 1995 to 2000. During this period, the Nasdaq went from below 800 points to over 5,000, growing more than five times in only half a decade.

Overconfidence, speculation, and easy access to capital led to one of the worst stock market bubbles in history. From professional traders to college students, everyone was making money and putting even more money into the market. Some investors even borrowed heavily so they could buy more stocks. During these five years, investing seems to be a safe bet – with no risk or downside.

The lack of fear and caution fueled the rise of many telecom and online companies. In 1999, the share of Qualcomm went up by 2,600%. People were blindly buying everything with a “.com” in its name. Yet, putting your savings into a market bubble is like playing a high-stakes game of musical chair. When the music stops, you might tumble to the floor. The more confident you feel, the closer you are to the fall.

The dot-com bust – the falls of the titans

While investors were busy chasing the new tech stars, they paid no attention to the actual operation of these companies. In reality, most dot-com companies spent an enormous amount of their capital on advertising, but they never made a profit. The motto of “go big or go home” adopted by many startups led to aggressive spending and even accounting frauds. The elevated stock price and the lacking financial performance of these companies set the stage for one of the worst crashes we have ever seen.

In February 2000, the Federal Reserve announced that it would raise the interest rate to slow down the overheating economy. Higher interest rates increased the borrowing costs for unprofitable dot-com companies and alarmed investors to reevaluate their investments. The increasing interest rate, lower investor confidence, and scandals of accounting frauds by companies such as Worldcom finally burst the five-year bubble. After peaking in March 2000, the Nasdaq went on a freefall. In October 2002, the Nasdaq has reached the lowest point at 1,114, erasing 78% of its value in only 18months. The crash was so fast and aggressive that some investors never dared to invest in stocks again.

Are we in a tech bubble again?

History repeats itself. With the aggressive growth of tech stocks in 2020, investors are on high alert for another tech bubble. This worry is not unjustified. There are many similarities between the stock market in 2000 and 2020.

Similarities between the dot-com bubble and 2020.

Easy access to capital

Whenever people have access to cheap borrowing rates, there is a risk of a bubble. Low interest rates can overheat the economy. Fundamentally, a low interest rate means that both investors and companies can have cheaper access to loans and debts. Companies are likely to borrow at low rates and expand their businesses. Low borrowing costs means lower yield in the bond market and investors are more willing to take on risks to generate more return in the equity market, fueling stock growth.

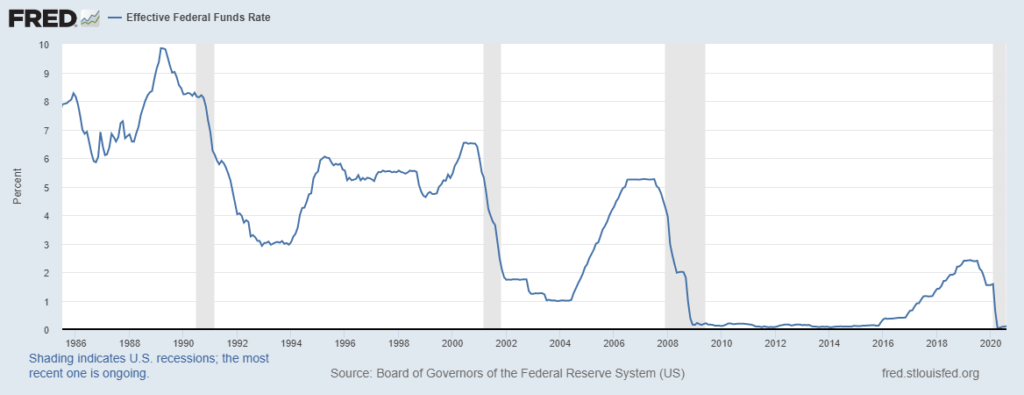

Between 1995 and 2000, the interest rate in the US was steady and relatively low compared to the previous decade. Oscillating around 5%, this interest rate level, although high by today’s standard, made borrowing cheaper for these dot-com companies, which promoted unhealthy expansion. A lower interest rate also made stock investing much more appealing and encouraged investors to take on more risks. After all, why invest in bonds when you can make triple-digit returns in the stock market in a year?

Compared to the 90s, today’s interest rate environment is even more profoundly low and accommodating. Since 2009, the Fed Fund Rate has been kept at the zero lower bound to help the economy recover from the Great Recession in 2008. While the Fed finally raised the rate in 2016, the recent Coronavirus outbreak forced central banks around the world to lower their interest rates again. Additionally, the Fed reinstated the Quantitative Easing program and purchased nearly 3 trillion dollars of bonds to support the economy, adding more money into the economy.

This historic low interest rate environment leads more capital into the stock market seeking higher investment returns. Currently, the 30-year US treasury bond yield is 1.41%. In comparison, Tesla stock has gone up by 300% in the last six months. The diverging returns of the stock market and the bond market further attract more investors to put their hard-earned money into stocks. With more money flowing into the stock market, stock prices grow and become overvalued.

The growth of first-time investors

There is a famous story about Joe Kennedy. Allegedly, a shoeshine boy gave him a stock tip in 1929. While the tip itself was inconsequential, the fact that even a shoeshine boy was gambling his money in the stock market signaled a market bubble to Kennedy. He subsequently sold his stocks right before the famous Black Monday market crash.

While we can’t verify the validity of this story, one thing is certain – as the bubble grows, more and more first-time investors jump on the investing wagon. During the dot-com bubble, the growth in the stock market and lucrative profit lured many new investors into the market.

New investors rushing into the market can be a warning sign of bubbles for two important reasons. First, new investors often get in on the gains late. They often get into the market near the tail-end of the bubble. This is because to mobilize these non-investors, the market first needs to have already made tremendous gains. In the case of the dot-com bubble, the 400% growth lured many critics and onlookers into putting their money in the market. When this happens, the market is likely already overvalued.

Second, inexperienced investors can fuel a bubble because they tend to speculate blindly rather than cautiously investing. New investors lack the tools and experience to accurately assess risk-reward. Instead, they are heavily influenced by market sentiments. During a bull market, they are more likely to buy stocks despite their high valuations. This continues to fuel the market bubble. These investors are also the first to leave the market when the correction happens. While seasoned investors might hold on to their positions, new investors often cut their losses and exit the market, contributing to more selloffs.

At the moment, we are seeing this exact pattern unfolds in the stock market. Despite the Coronavirus outbreak, 2020 saw a record-breaking number of new accounts from retail investors. Online brokers such as Charles Schwab and Robinhood have seen a significant influx of new investors onto their platforms, trying to make a fast profit.

| Trading Platform | New accounts Q1 2020 | New accounts Q1 2019 | year-over-year increase |

| Charles Schwab | 609,000 | 386,000 | 58% |

| TD Ameritrade | 608,000 | 244,000 | 149% |

| Etrade | 363,000 | 135,000 | 169% |

Source: Factset CNBC

These new investors are young and they invest in stocks from tech companies they are familiar with such as Apple, Amazon, and Tesla. This influx of retail investors is part of the reason that tech stocks have outperformed other sectors during the recovery from the Coronavirus market crash.

Investing in a promise

The last similarity between the current market and the dot-com bubble is the tendency to invest in tech companies for their promises rather than their business operation and cash flow.

During the dot-com bubble, investors were investing in many companies based on the technological advancement they promise. The passion for the internet and its potential led investors to ignore all business fundamentals such as profitability and solvency, which were ultimately the downfalls of these companies. Investing in stocks is to own a share of a company and businesses need profit and cash to stay afloat. When investors invest in empty promises from companies instead of their fundamentals, the market bubble continues to grow.

This mentality is now most clearly visible in Tesla stocks. Since March, Tesla stocks went up by nearly 600% at the end of August 2020, inflating the company’s price-to-earnings ratio to over 1000. Much of the hype comes from investors who focus merely on its technological promise. However, the stock price cannot be sustained on promise alone, even when the stock is TSLA. In September, Tesla stock has lost 40% of its value, leaving many wondering if this is another sign of a potential market crash.

One key difference – the Fed’s policies

Despite the similarities between the dot-com bubble and the 2020 tech rally, one factor might unilaterally decide where the stock market will go from here – the Federal Reserve.

The burst of the dot-com bubble was largely facilitated by the Fed’s decision to raise the interest rate to prevent the economy from overheating. While inflation was rather tame in 2000, the Fed saw significant excess demand in the economy that could lead to high inflation in the future. Consequently, even before the Nasdaq reached its peak in March 2000, the Fed has signaled rate increases.

On the other hand, the current environment could not be more different. As the global economy continues to struggle with COVID-19, the Fed’s rate policy is closely tied to the economic recovery. The last meeting minutes from the Fed suggests policymakers believe that the economy needs more help from both the government and the central bank. As a result, the Fed will be unlikely to take any aggressive actions to increase the interest rate. With the interest rate kept low, investors including mutual funds and hedge funds will have to keep investing in risk assets such as stocks to meet their target investment returns

Watch the interest rate like a hawk

It is without a doubt that the current stock market is overvalued. However, given the low interest rate, investors are unlikely to find a new way to invest their money. Consequently, where the stock market will go from here depends heavily on the interest rate policies from the Fed. While the Fed is unlikely to raise the interest rate any time soon, wise investors will keep paying close attention to the Fed and their interest rate policies. Just like a game of musical chair, when the Fed finally stops singing, we might just find ourselves in another bubble about to burst