What is one thing that over-spenders hate and your future self wishes you would have done more of? The answer is budgeting. Before you click away from this article (perhaps forwarded to you by your dad), let me share this with you. I get it. Even as a finance professional, I hated budgeting for the longest time. Budgeting can force us to confront our unwise spending decisions on eBay or at that local bakery. But as I learned, budgeting doesn’t have to be boring and triggering. When done right, a budget can empower and help you spend more confidently and wisely.

A good budget can help you live better

Budgeting has a bad reputation. It has a bitter aftertaste like a spoonful of sugar followed by the medicine Mary Poppins forced down your throat. However, budgeting is not about denying yourself. In fact, a good financial plan allows you to spend more on things you love and need by eliminating unnecessary wastes. Here are four things a good budget can help you achieve.

Discovering quick savings

Metaphorically, a budget-less person is constantly in a foggy forest with financial dementors floating around looking to destroy their happiness. The point is if you don’t budget, your money might get sucked away by things you can’t even see.

I realized the power of budgeting while I was living in London. The tube (subway) in London is world-class: fast, elegant, and stereotypically quiet. Unfortunately, it is also deceivingly expensive. The London tube allows you to use contactless cards to pay for your fares. It’s very convenient to tap in and out of the tube without knowing the actual costs of your travels. When I first started budgeting, I tallied my monthly tube fares and realized that it was a staggering £230 per month. A monthly pass was only £134. So I had been unknowingly throwing away £96 each month for almost a year.

Today’s consumers can easily fall prey to money-losing mistakes such as forgotten subscriptions and overdraft fees. Without budgeting, you simply don’t know what is costing you money and what you can do to save. Sometimes, substantial savings can come as easily as buying a monthly transportation pass.

Budgeting helps you find these items so you can save and spend the money on things you need and love.

Eliminating guilt

Spending guilt is the unpleasant cramp you get each time you buy things you know shouldn’t buy. Surprisingly, budgeting is very effective in reducing spending guilt. With foresight and planning, you know confidently that you can spend the money without getting into financial trouble. A smart budget allocates money to things you enjoy like a horse face mask or monthly visits to the trampoline park. As a result, budgeting helps reduce spending guilt without denying you happiness.

Encouraging future planning

Budgeting is a really powerful tool to help you save. First, as mentioned above, when you budget you will definitely come across things you can save money on without effort. This leaves you more money to save and invest.

Additionally, budgeting helps people get into the habit of saving. By making saving a part of your monthly financial planning, you can set saving goals and work towards it. This is wonderful because overtime your savings can grow and you will have more money to spend in the future.

Earning you a “Responsible Adult” budget

Here you go. You are welcome!

How to make a budget

Now you are an eager budgeter, let’s talk about how we can get you started! Here are all the tools you need to start budgeting today.

Tallying your income sources

The first step is to establish your monthly “wallet”, the total amount of money you can spend and save. This is easy if your income is neatly printed on a check. If you have more than one source of income, you will need to add them up across different channels. If you can, try to include your tax refund and bonuses.

If your income is seasonal or includes tips, it is better to average it out for the past three months to get a general figure as an estimate. For safety, you can then subtract 100 dollars from that number. This will be your “wallet”, your maximum spending power.

Reviewing past spending

Confronting your past spending decisions can be exciting and intimidating. In doing so, you might ask yourself “did I buy that?” or “why did I buy that?” many times. Think of reviewing past spending as a financial purge. You can immediately pick up some savings by unsubscribing to an old streaming service or detecting hidden transaction fees from banks. I personally cut about $150 worth of avoidable expenses when I carefully reviewed my spending.

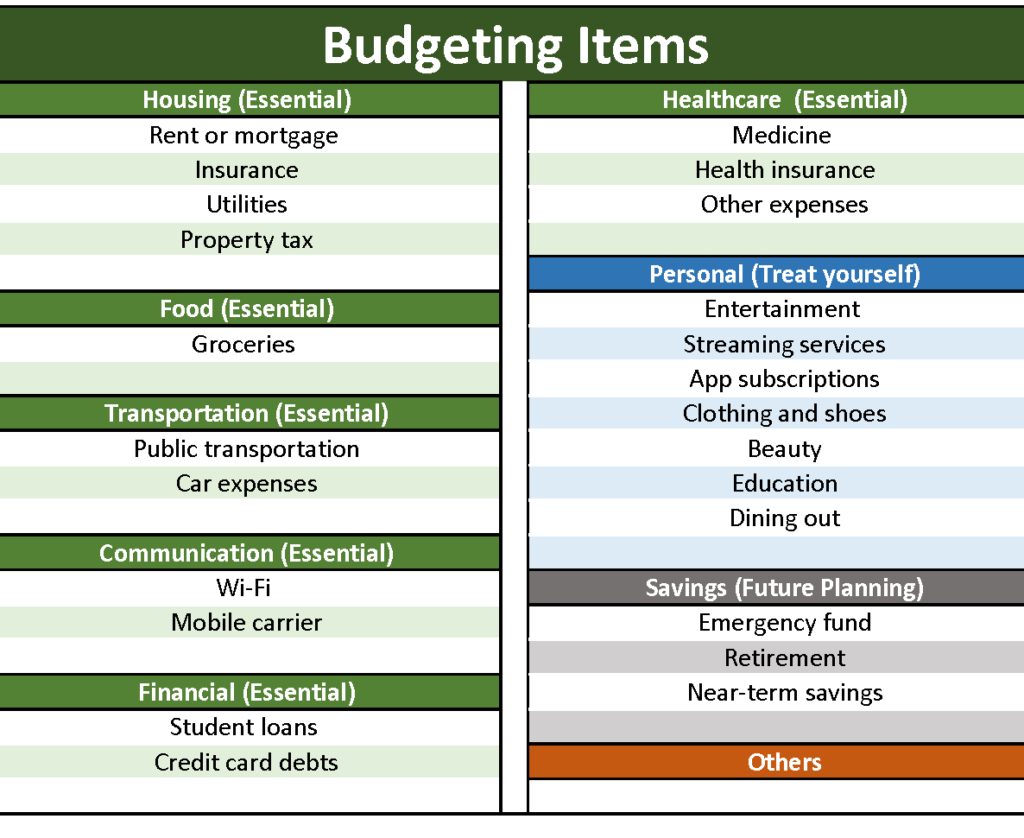

You can tally all your spending into the following categories: housing, food, transportation, communication, financial, healthcare, savings, and others. You can personalize the categories to fit your habits and priorities.

The easiest way to do this is by logging into your online banking account and downloading the transaction history into a spreadsheet. If you sort the items by vendor name, you can group them quickly and sum up the total spending by vendor and category. Many online banking services also categorize your spending for you. It will make this step much easier.

Allocating expenses

With a good understanding of your income and spending habits, you now get to choose and plan how you use your money for the next month. No two budgets look alike. Based on your particular circumstances you should list out all expenses and savings you expect to see in the following month. You can use the table below to help you outline your expenses and change it to fit your needs.

Generally, a good budget has three components: essential spending, non-essential spending, and savings. Essential spending includes rent, groceries, and healthcare. Non-essential includes dining out, traveling, and other things that bring you joy.

For your first budget, we recommend you to allocate 50% of your income to essential spending, 30% to non-essential spending, and 20% to savings. If you can cut down the first two and increase savings, then more power to you!

If you currently have student loans or credit card debts outstanding, it is a good idea to prioritize paying down debts first before saving. These debts have higher interest rates than the returns on most investment portfolios. Thus, you can benefit more from paying down debt than investing.

A common mistake for new budgeters is that they are overly aggressive and create unrealistic plans. When they fail to achieve their unattainable goals, they give up completely and resort to old habits. Consequently, it is better to first create a budget that is lenient and allows for personal happiness than a strict and painful one. You can always increase savings later once following a budget becomes a habit.

Tracking your spending

With your shiny new budget, the next step is to track your spending. You don’t have to track everything as they come in. Instead, you can do this every Sunday. Use the same method to download your transactions from your online banking portal and sum up the expenses by category. You can then see how much you have spent versus your goals. A weekly review can help you stay on track.

Trial and error

Budgeting is personal. There is no one method that works for everyone. If your budget doesn’t work well, simply make some changes or make a new one. With time you will find the method that works best for you!

Don’t get frustrated if your first attempt is not perfect.

You should take pride in your efforts and know that you are contributing to your financial future.

Tools for budgeting

The budgeting process we have just learned is the method of zero-based budgeting (ZBB). The idea is to tag all your income for a purpose. This way it reduces ambiguity and casual spending. There are many tools that can help you with the budgeting process. Choose your weapon!

The envelope method

If you are a big cash user, this method just might be perfect for you. After planning out your expenses, you can put cash into different envelopes. Each represents an expense item. When you need money, you take it out of the corresponding envelope. It is a highly visual method because you can also physically see the amount left in each envelope. This method is effective but can be inconvenient in this digital age.

Budgeting in Excel

An Excel spreadsheet is a fantastic tool for budgeting because it can make quick calculations and create highly informative graphs to help you understand your expenses. It is also flexible and caters to any budget and calculation you need. My colleagues at Wall Strategies have created a beautiful and functional spreadsheet to help you make your monthly budget and track all your spending. You can download the free Wall Strategies budgeting sheet here.

Budgeting apps

The most convenient way to budget is through apps on your mobile phones. There is a universe of budgeting apps you can use. Using an app cuts down the work needed to track your expenses. Most apps connect to your debit and credit cards and categorize each transaction as it occurs. They track your spending against your goals. If you are interested in using an app, here are some popular ones for you to research: Mint, PocketGuard, and Wally.

Your choice of budgeting tool depends on your needs. If you value convenience, budgeting apps can make your life easier. If you prefer a more DIY approach, the Wall Strategies excel spreadsheet is really all you need.

Get to it!

Budgeting is like going to the gym. Sometimes it is hard to find motivation. But if you stick to it, you will be rewarded with impressive (financial) muscles. After all, budgeting doesn’t take away your hard-earned money; it just helps you save a little more and spend it a little wiser.