The New Year’s Eve of 2008 was full of hope. With rapid economic growth and a booming housing market, many people felt richer than ever before. However, only a few months later, the world was hit by one of the worst recessions ever. A never-ending bull market doesn’t exist. Like the changing seasons, an economy also has a natural cycle of boom and bust. The business cycle directly affects your profits and losses as an investor. A firm grasp of the business cycle is a useful tool to understand where the market is headed.

What is the business cycle?

In theory, the business activities in an economy should remain stable as supported by its technology and natural resources. But that’s far from reality. The actual business activities in a country are affected by factors from consumer sentiment to monetary and fiscal policies. The actual output skyrockets when the economy overheats and plummets during a recession. This alternation of economic expansion and contraction in business activities is the business cycle. It is also called the boom and bust cycle.

The four stages of a business cycle

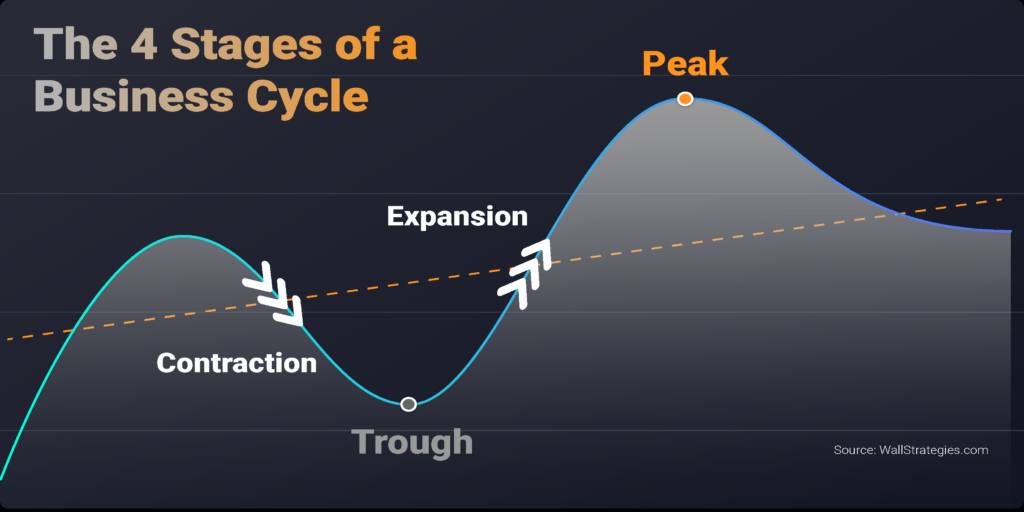

A complete business cycle has four distinctive stages: expansion, peak, contraction, and trough. The peak and trough are the highest and lowest points of a business cycle. At the peak, strong consumer demand and confidence lead the economy to overheat and overproduce. A trough, on the other hand, represents the bleak reality of economic contraction and slowdown.

- Contraction: after reaching the peak, the economy operates above its maximum capacity. The unsustainable level of activities will inevitably begin to contract. In a contraction, business activities slow and profitability falls. Companies are forced to let go of their employees to cut costs. Many who can’t survive the contraction will file for bankruptcies, leading the economy to bottom at a trough.

- Expansion: on the other hand, an expansion is marked by growing business activities and strong consumer confidence after a trough. The economic recovery and optimism lead companies to hire more workers and create more jobs. With more jobs, consumers have more money to spend, which leads to even more economic expansion.

Investing using the business cycle

It might have occurred to you that if a business cycle can sway the trajectory of an economy, it must have a huge impact on the stock market as well. You are correct. Although business cycles don’t always coincide with market cycles. These two are closely and fundamentally related. Each level of your investment decision process can benefit from a firm understanding of the business cycle.

Mastering the business cycle allows you to predict the direction the market is headed, update your investment strategies, and avoid getting caught in a market peak right before a recession such as the 2008 financial crisis.

Can a company survive the business cycle?

The business cycle is a major driver of profitability for businesses. During an expansion, high household income and low unemployment rates lead to a growing demand for products and services. Responding to the demand, companies are selling more products and often at higher prices.

On the other hand, economic contraction is bad news for businesses. With the economy slowing down, people begin to lose their jobs and grow cautious with their spending. Lower consumer demand then causes businesses to let go of more employees. This is a vicious cycle that often results in a recession. In the process, companies suffer heavy losses and many will go bankrupt.

For investors, understanding the strength of a company’s financials and its ability to survive a contraction is critical. Does the company have enough cash to support lowered revenues? Is the company overleveraged with debts? These are important questions for investors who want to build a recession-proof portfolio.

Which sector to invest in?

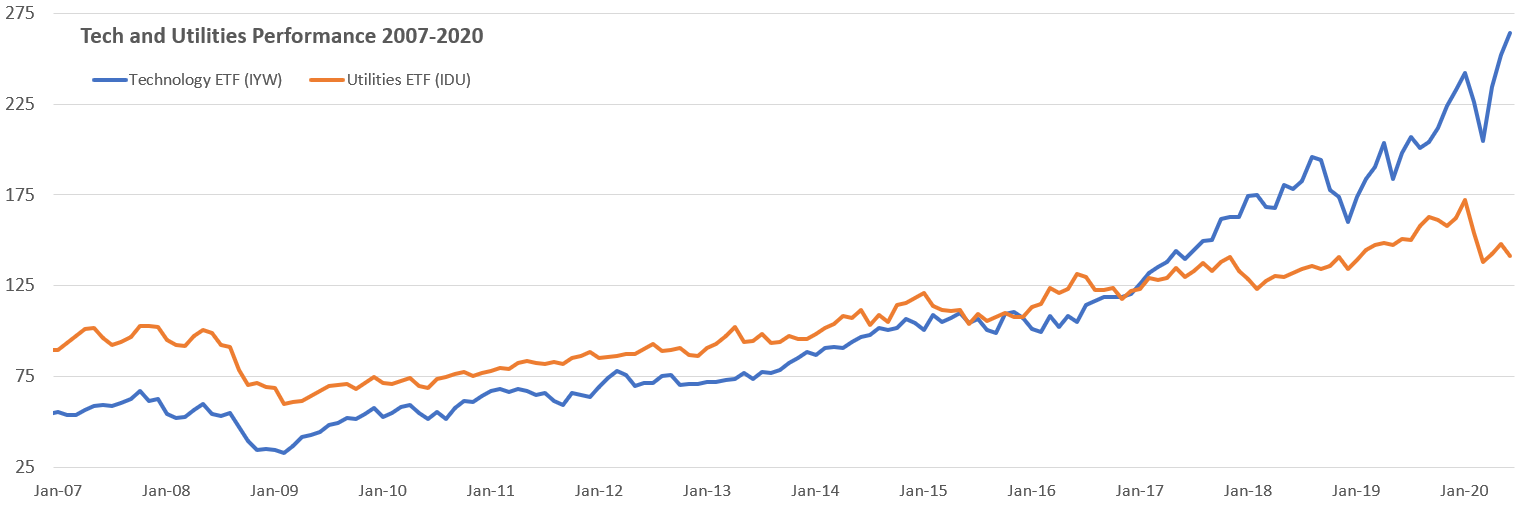

What we learned from analyzing the business cycles is that not all sectors are affected equally by the contraction and expansion. Technology, consumer discretionary, and financial stocks are more sensitive to the business cycle than utilities and consumer staples. On average, technology stocks outperform utilities during an expansion, but they also decline more quickly in a contraction. On the other hand, defensive stocks such as utilities and consumer staples have more steady performances across different stages of a business cycle.

This means that knowing which stage of the business cycle we are in gives us insight into which sector we should focus on. Based on this understanding of the business cycle, investing in tech stocks during an expansion will provide higher returns than investing in sectors such as utilities. Here is a real-world example from 2008.

In this chart, we have the historical prices of two ETFs – iShares U.S. Utilities ETF (IDU) and iShares U.S. Technology ETF (IYW). We can see that during the recovery from the Great Recession technologies performed much better than utilities. Even though both sectors benefited from the economic recovery, technology’s high sensitivity to the economic cycle helps boost its growth and generate higher returns for investors.

Where you should put your money – asset allocation

Aside from sectors, different asset classes such as bonds and equities also respond differently to business cycles. Famously, stocks have poor performances overall in contractions because businesses suffer lower demand and have to scale back their operations. On the other hand, bonds often outperform during a recession with its stable and predictable cash flow. Many AAA bonds and especially the US treasuries are considered safe havens by investors. Thus, bond prices tend to rise when investors are fleeing to safety. Additionally, during a recession central banks are also more likely to implement accommodating monetary policies that lower interest rates and help boost bond prices even more.

During an expansion, the story is pretty much the opposite. Stocks rise quickly during an expansion but bonds are less favored due to its lack of growth potentials.

With a portfolio of diverse investments, seasoned investors should adjust their allocations to bonds and stocks with the business cycle as well. Expansionary periods offer opportunities to take advantage of the growth of stocks. Ahead of a recession, investing in high-quality bonds can offer stability and income.

Avoid an overheated market

Lastly, understanding the business cycle can help you decide if you want to invest in the market at all. Ironically, before the worst market crashes in history such as the dot-com bubble or the 2008 housing market crash, investors are most bullish. From traders to grandparents, everyone was making money from the market and they were all confident that the trend would continue. The overconfidence and frenzy often signal the peak of a business cycle and foreshadow a painful contraction.

Should you invest all your savings knowing that the market is peaking? Most likely not. Understanding the business cycle gives you to tool to be smart and strategize how much you want to invest in the market. When the market is overheated and the economy is at a peak, you might want to take a break before putting your hard-earned money into the market.

Limitations of business cycle investing

Understanding the business cycle and its impact on investments can guide your investment strategy and enhance your ability to generate returns. But business cycle investing also has its limitations.

First, external shocks that are completely unforeseeable can affect a business cycle. For example, the Coronavirus outbreak in 2020 sparked a global economic panic. As a result, the Coronavirus outbreak led to a largely unexpected recession. In fact, before the pandemic, the US economy was strong and booming.

Second, assessing which stage of the business cycle we are in is not straightforward. Business cycles are clear in hindsight. However, it’s much harder to assess it as we are living through it. Most economic indicators such as GDP is reported quarterly, which makes assessing a business cycle much harder.

Because the four stages of a business cycle are blurry and subject to unforeseeable shocks, some investors prefer to invest through a dollar cost average approach to mitigate the timing risk. You can learn more about the benefits of dollar cost averaging here.

Extra: most recent economic peak and trough

According to the National Bureau of Economic Research, the last economic trough in the U.S. was recorded in June 2009 after the Great Recession. The most recent peak was in February 2020. What this means is that we are about to enter the contraction phase of the business cycle, after a record-breaking 128 months of economic expansion.