In January 1992, Yugoslavia experienced one of the worst inflation in human history. In only a month, the prices for almost everything went up by 313,000,000%; with this inflation rate, a slice of pizza that costs $1 now would be worth $3,130,000 in a month. This is an example of hyperinflation – an extremely aggressive rise of prices in an economy.

While hyperinflation is rare, most economies experience some inflation, a rise in prices, every year. It turns out that inflation affects almost every aspect of your life. A high inflation rate increases the cost of living, lowers your real wages, and erodes the value of your hard-earned savings. In this article, we will discuss what inflation is and what you can do to protect your savings from it.

What is inflation?

The prices of food or rent might seem stable, but they can change over time. For example, in 1908, you could buy a brand-new Ford Model T with $825. However, thanks to a century’s inflation, today $825 can barely cover the insurance on your car.

Inflation captures how prices of products and services in an economy change over time. A yearly inflation rate of 5% suggests that the prices have grown by 5% compared to last year. For example, things that you could buy with $100 last year now will cost you $105. A high inflation rate tells us that prices have been growing fast while a low inflation rate suggests a stable price level in the economy.

What causes inflation?

Inflation can be caused by excessive demand. For example, during the Coronavirus crisis, the demand for PPE such as hand sanitizers and masks surged. People were willing to pay more for these protective products. The price for these items went through the roof!

Another form of excess demand happens when there is a large amount of money in the economy. When there is more money chasing after the same amount of goods, prices will go up. For example, the Quantitative Easing program from the Federal Reserve can release a large amount of money into the economy with the potential to boost inflation.

Rising costs of raw materials, wages, and energy can also lead to inflation. Imagine a scenario where all workers suddenly demanded twice their wages. What would happen to prices? Companies will take the hit and pay higher wages but they will also charge higher prices for the products because the cost of production has gone up. Consequently, inflation will also rise because of the increase in wages.

How is inflation measured?

Most countries track inflation with Consumer Price Index (CPI). With CPI, the government tracks the price of hundreds of goods and services important to households such as food, energy, clothing, rent, and more. By comparing the cost of these goods yearly, CPI shows us how the price level has shifted in the economy.

Another measure of inflation is the Producer Price Index (PPI). While CPI measures the cost for consumers, PPI measures how the cost of production shifts. A change in raw material prices affects not only the producers but also consumers like us. When the price of raw materials goes up for a factory, the company will have to increase the price of its products to compensate for the high costs. Inflation will eventually reach consumers.

Current inflation rate

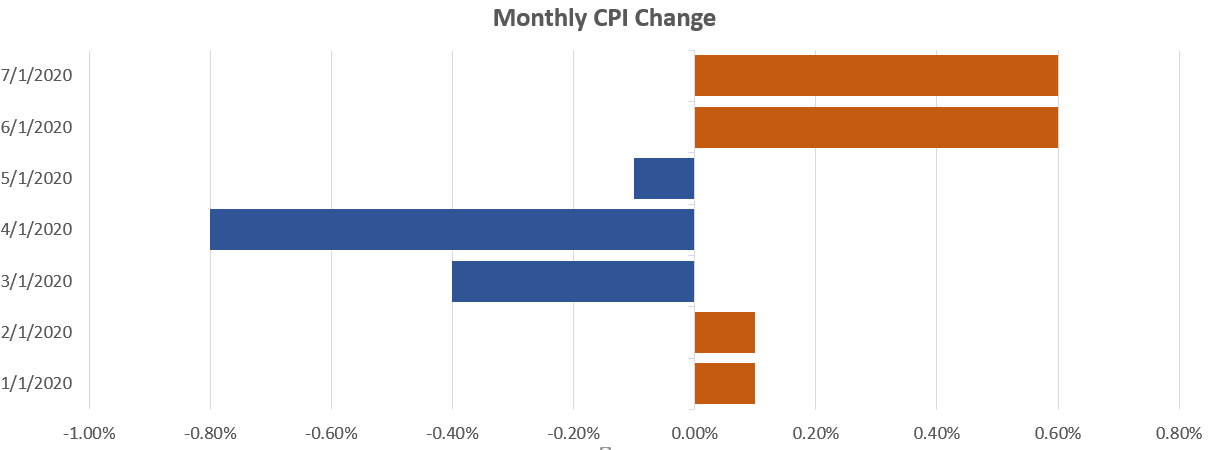

In the US, the Bureau of Labor Statistics releases CPI data on a monthly basis. The current rate of inflation for July is 0.6%. In the chart below, you can see that before the Coronavirus outbreak, CPI in the US was growing at a moderate rate of 0.1% per month. However, in March CPI dropped by a significant 0.8% as a result of stay-home orders. With closed stores, people were buying less. The layoffs that happened during the pandemic also made consumers more cautious with their spending.

Since the reopening in June, the monthly inflation growth jumped up to 0.6%. The pent-up demand from consumers led to more shopping activities across the board, pushing prices higher. More importantly, there is also more money in the economy, as a result of the monetary policy from the Federal Reserve.

Is inflation going to increase?

Inflation is likely to remain high in the US for the next few years, because of the monetary policies in the US.

To prevent a disastrous recession from the Coronavirus, the Federal Reserve poured nearly 3 billion dollars into the economy through the Quantitative Easing program since March 2020. While the money supply helped banks and businesses stay afloat, it also builds up inflationary pressure in the economy. Large money supply in the economy can push the prices higher. Consequently, we are likely to see higher inflation in the next couple of years in the US.

How does inflation affect you?

In short, inflation makes you poorer. Why? With higher inflation, your money is worth less every year. Although the face value of your money does not change, it has less purchasing power and is less valuable.

Increase your cost of living

The most direct impact of inflation is higher grocery bills and rent. Elevated inflation signals that the prices of most basic consumer products in a country, from cereal to monthly rent, are going up. Your money will buy fewer groceries, less gasoline, and rent smaller apartments.

Reduce your real wages

With a higher cost of living, it takes more to just cover your basic expenses. Most of the time, wages do not catch up with inflation immediately. You might take the same amount of money home but high inflation has the same effect on your real income like a pay cut.

Shrink your investments

Investment returns (nominal returns) are calculated without taking into consideration of inflation. You could still be losing money with a positive return on your investment. For example, if the return on a bond portfolio is 3% a year but the inflation is 4%, your purchasing power actually decreases by 1% every single year. Essentially you are still losing money because while you will have 3% more in the bank, your money will worth 1% less at the stores.

This is why a high inflation rate can erode your investment return without you even noticing it. Investments such as bonds and certificates of deposits (CD) are particularly suspectable to high inflation because they have fixed returns that can be overshadowed by large price increases.

How to protect your money from inflation?

Inflation is the reason why hiding money under a mattress is a terrible idea. Well, one of the many reasons. Earlier, we talked about how fixed-income investments can be vulnerable to inflation. This is true. But holding cash is even worse. Stone cold cash is most vulnerable to inflation because cash doesn’t offer any appreciation to offset inflation. The more cash you hold, the more inflation affects you.

If you anticipate high inflation, there are several investment options that can help you hedge against it and protect your hard-earned money.

Gold

Gold is the traditional anti-inflation investment asset. Gold serves as a hedge against high inflation because it is not only an investment but also a commodity itself. Unlike cash or credit, gold has a stable supply that protects its value from erosion. Additionally, when inflation is high, the true value of dollars decreases. As a result of the depreciation of dollars, gold will become more expensive, offsetting the impact of inflation.

Investing in gold has a few downsides. First, unlike fixed-income investments such as bonds or CDs, gold doesn’t offer any income. After buying gold, investors only make money when selling the gold with a capital gain. If you are looking for an investment that offers a regular income stream, gold is less than an ideal investment.

Treasury Inflation-Protected Security (TIPS)

Treasury Inflation-Protected Security (TIPS) is a fixed-income investment product issued by the US treasury. TIPS are a great option for investors to reduce their inflation risk while still receiving regular income. TIPS are issued with 5, 10, and 30-year maturities with semi-annual coupon payments.

What makes TIPS so special is its ability to adjust to inflation. Every six months, the principal investment is adjusted by the inflation rate and then the coupon is paid on this new principal amount. This guarantees that your investment can keep up with inflation and have additional returns to spare!

Let’s use an example to illustrate how TIPS work. An investor has invested $2,000 in TIPS with a 5% coupon rate. In the first year, the inflation rate was 10%. Here, the original $2,000 investment will be first adjusted by the inflation rate. As a result, the face value of the bond is now $2,200 instead. The coupon payment will then be calculated based on the new face value and the 5% coupon rate. By adjusting the principal, TIPS protect both the principal and coupon payments from inflation.

The downside of investing in TIPS is that they have slightly more complicated tax implications. The change in the face value is considered taxable income. In the example above, the investor will have to report the $200 as taxable income even before the bond matures.

Real estate and land

Similar to gold, houses and even vacant lands can be used as inflation hedges. Housing prices and inflation have a positive correlation, which means that higher inflation often comes with higher housing prices. This is because real estate goes up when inflation is high in the economy. As dollars depreciate, real estate prices will go up and help investors protect their investment. Real estate investments also have use value and can generate passive income in the form of rent.

Real estate serves as a great hedge against inflation, but these investments are harder to cash in. Selling a house takes longer than selling bonds or even gold nuggets. These investments also take a larger amount of capital than TIPS and gold, which makes it unavailable to many investors. If you want to invest in real estate without putting down thousands of dollars, REITs might be a great option for you.

Bitcoins

While inflation means that money is worth less, deflation makes a currency more valuable. This is where Bitcoin comes in. Bitcoin has a built-in deflation. There is a limited amount of Bitcoin – a total of 21 million. New Bitcoins enter circulation through a process called mining, and once all 21 million Bitcoins have been mined, there will be no more new Bitcoins added to circulation. With a fixed amount of money supply, Bitcoin is designed to deflate and appreciate over time.

Another reason Bitcoin can serve as a hedge against inflation is that Bitcoin is an alternative currency. Bitcoin price tends to rise when people lose faith in the mainstream economy or dollars. As people divest from dollars, Bitcoin can benefit from the increased demand. As dollars depreciate, Bitcoin will become more valuable as well.

However, Bitcoin carries more risk as an investment. The high volatility of Bitcoin price means that while you could make a good profit, you can also lose a lot of money. When compared to stocks, Bitcoins are much riskier. We calculated the daily price change for Bitcoin and the S&P 500 index from January 2014 to September 2019. While the highest daily rise is 5% for the S&P, it is 25% for Bitcoins. Additionally, the largest daily drop for Bitcoin is 21% while it is only 4% for the S&P.

While putting a small amount of money into Bitcoin could help you diversify your portfolio, exposing your savings to more risks just to hedge against inflation is not a great idea.