On March 11th, the World Health Organization (WHO) declared that COVID-19 had become a pandemic. Initially a health crisis in China, the Coronavirus has quickly evolved into a global financial nightmare for investors. As the disease spreads, it disrupts production and halts businesses. As a result of the expected economic slowdown, US equity fell into bear market territory in merely a week. Amid the ongoing crisis and more potential pain in the market, some investors are wondering if it is time to move their money into gold. While gold can protect investors from crises, the lesson from 2008 shows that gold price can actually drop drastically in a financial crisis.

What is happening in the market?

The Coronavirus crisis has shocked U.S. investors and ended the 11-year bull market with steep daily declines. In fact, we haven’t seen a market selloff this severe since 1987. Concerns over the Coronavirus led the S&P to plummet by 9.51% on March 12th, a selloff greater than the biggest daily drop during the 2008 subprime crisis.

As markets around the world fell into turmoil, central banks shoulder the responsibilities to combat market crashes and a looming global recession. The Fed surprised the market on March 15th by lowering the fed fund rate to zero and re-starting the Quantitative Easing program, a measure used to combat the aftermath of 2008.

Despite the drastic monetary policies from the Fed, the stock market declined by another 12% on Monday, signaling growing investor concerns over the Fed’s ability to stabilize the economy.

How did the Coronavirus tank the financial market?

The Coronavirus is highly contagious. When left alone, this disease can infect millions and completely overwhelm even the most well-prepared healthcare system. To control the spread of COVID-19, countries around the world have implemented various policies. However, fighting the virus comes at the cost of suspending work and school, leading to a general halt of economic activities across the board.

Factories will stop making new products which can lead to a great decline in economic output and a shortage in supply of everyday products. Airlines are suffering as countries implement travel bans and consumers cancel their trips. While larger corporations suffer losses from empty and closed stores, small businesses struggle to even stay afloat while borrowing money to pay rent and employees during the shutdown.

A foreseeable slowdown in the economy and reduced profitability for many companies led the stock market to sell off. Additionally, growing concerns over whether governments and central banks can contain the impact of COVOD-19 drove more investors to sell their stocks in a panic. As of right now, we are still unclear on the real impact of the Coronavirus and how long the crisis will last.

Gold – an intuitive “safe haven”

Gold has been considered a safe haven by investors for hundreds of years. As a precious metal, gold has a limited supply and can keep its value over time. Additionally, because gold is a commodity, not a currency, it can fight inflation when the dollar loses value. When the economy is heading to a recession, investors tend to move money out of risky assets such as stocks and use it to buy gold.

However, buying gold at first sight of a financial crisis is not always a good idea. While gold can be used as a safe haven in the long run, there are other forces at play that can cause its price to drop drastically during the short-term. In fact, during the initial period of the 2008 financial crisis, gold plummeted along with the stock market.

Gold price tanked in 2008

When the Fed stepped in to bail out Bear Stern and other bond dealers on Wall Street in March 2008, gold soared above $1,000. Anticipating a financial crisis, investors moved their money into gold to preserve their capital and expected further gold appreciation. However, the subsequent events shocked investors. As the stock market crumbled during the crisis, gold didn’t go up as expected. Instead, gold fell throughout 2008 and only recovered in 2009.

Falling gold price perplexed investors who fled to gold as a safe haven. Why did gold, a safe haven asset, fail to protect investors at the height of the 2008 financial crisis?

The lesson from 2008

Without a doubt, gold price is affected by supply and demand. When investors foresee a crisis, they sell risky assets and buy gold. This creates an upward momentum for gold price. However, demand from investors is only one factor that affects gold pricing. A few other mechanisms of our banking and monetary system can help explain the selloff of gold in 2008.

Reason No.1 – the strengthening of USD

As the financial crisis unfolded, the demand for USD increased drastically. US companies were struggling for dollar liquidity. International financial institutions and trading companies were also looking to buy dollars to cover their obligations denominated in USD. As a result, the demand for dollars grew and the value of USD increased significantly.

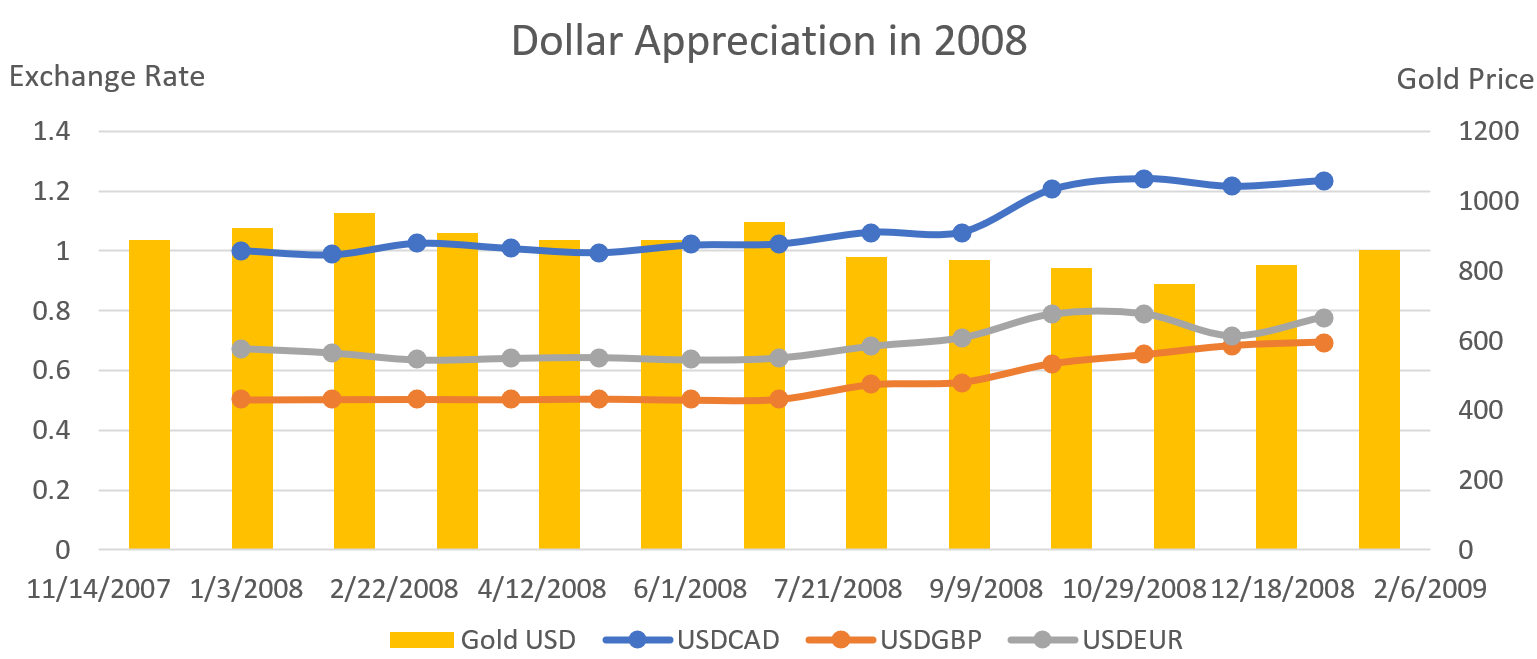

As shown in the chart below, USD appreciated greatly against the Canadian Dollar, the British Pound, and the Euro during 2008.

When the dollar becomes more valuable, the relative valuation of gold against the dollar goes down. That’s exactly what happened in 2008. The demand for dollars drove up its value and pushed gold price lower. During the exact months when USD had the biggest rally in 2008, gold price went down the fastest.

Reason No.2 – golden collateral

During the 2008 financial crisis, many banks and traders were running out of collateral they could use to borrow money. As a result, more banks used gold as collateral for loans so they could borrow more dollars. An increase in gold collateral artificially put more paper gold supply into the market. Higher supply outweighed the increased demand from investors. This, in turn, led gold price to go down. Additionally, bullion banks raised liquidity by selling physical gold into the market, which further lowered gold price.

As a result, instead of appreciating, gold dropped like a stone during the peak of the financial crisis. It was not until 2009, the demand for gold finally triumphed and pushed gold price higher. The lesson from 2008 is that while gold can be a safe haven to preserve capital, there are other forces at play in the banking system that could lead gold price to go lower during a crisis before it can go higher.

How would the Coronavirus affect gold price?

Understanding the lesson from 2008 is extremely important to investors who are considering buying gold as a response to the Coronavirus crisis. As established, gold doesn’t automatically go up during a crisis. In fact, what 2008 taught us is that gold price might even go down during a crisis and recover later.

So far, the performance of gold during the Coronavirus crisis is very similar to that of 2008. We have seen USD strengthening against CAD and GBP. Additionally, despite an initial rally in early March, gold has been falling with stocks as the crisis deepens. This again contradicts the traditional belief that gold is a safe haven when stocks are volatile.

Consequently, investing in gold should not be a knee-jerk reaction in face of a crisis. In practice, gold can be highly volatile during a crisis before it eventually stabilizes and assumes its function as a safe haven. As the Coronavirus wreaks havoc globally, investors should keep this lesson in mind when considering investing in gold.