Exchange-traded Funds (ETFs) can replicate the performance of a particular sector or a market index. But did you know that ETFs can do more than that? Some ETFs such as the SQQQ and TQQQ use aggressive investment strategies to provide multiple times of the return of the index they track. While leveraged ETFs appear simple, they are much more complicated than regular ETFs. In this article, we will explain how SQQQ and TQQQ work and how you could leverage them to boost your investment return.

What are SQQQ and TQQQ?

SQQQ and TQQQ are leveraged ETFs. Normally ETFs like QQQ or SPY track the performance of a stock index such as the Nasdaq 100 and S&P 500. They achieve this goal by holding a portfolio of stocks with similar weights as the index they want to track. Leveraged ETFs are unique because they are not “tracking” the performance of an index. Instead, they try to deliver multiples times of the daily return of the index by using derivatives such as swaps and futures.

TQQQ is a 3X leveraged ETF. Its objective is to deliver a return that is 3 times the daily return of its target index – the Nasdaq 100. This means if the Nasdaq goes up by 1% today, TQQQ should go up by 3%. This gives investors leveraged returns that exceed what index ETFs can offer. However, it’s important to keep in that that losses are also amplified by three as well.

- Net Assets: $3.86 billion

- Net Expense Ratio: 0.95%

SQQQ is an inverse leveraged ETF on the Nasdaq 100. It aims to deliver -3 times the return of the Nasdaq 100. For example, if the Nasdaq 100 grows by 1% today, SQQQ will have a -3% loss. Investors profit when the underlying index, the Nasdaq 100, goes down. This is why it is called an inverse leveraged ETF. You can think of SQQQ as shorting TQQQ.

- Net Assets: $1.42 billion

- Net Expense Ratio: 0.95%

(Data: ProShares, March 2020)

When to use SQQQ and TQQQ?

SQQQ and TQQQ can be used to express a bullish or bearish view on the underlying index, the Nasdaq 100. The Nasdaq 100 is a stock index of 100 large-cap stocks mainly in the technology sector. Some of its largest holdings include Microsoft, Apple, and Amazon. When investors are bullish on the Nasdaq, they can invest in TQQQ to get 3X the daily return of the target index. On the other hand, a bearish investor can express their views via the inverse leveraged ETF – SQQQ. The 3X leverage on both ETFs gives investors the tools to gain outsized returns missing from regular index ETFs.

Leveraged ETFs are useful to express market views in the short-term but they are not suitable for long-term investment. This is because of the high level of risks involved in such investments due to their structure. While it is enticing to use TQQQ to outperform the market, understanding the risks is a key step to avoid unnecessary losses.

Elevated and compounding risks

Leveraged ETFs such as TQQQ and SQQQ are popular among investors with aggressive goals and large risk appetites. Unfortunately, not everyone who invests in these products is aware of the risks involved. When used correctly, leveraged ETFs are effective ways to boost your returns but the rewards come with high risks.

To deliver 3x or -3x of the index’s daily return, fund managers have to use derivatives such as swaps and futures. The portfolio is engineered to have a 3X leverage but the complex structures also expose investors to many additional risks. For example, derivatives transactions are subject to counterparty risk – the risk that the counterparty might not fulfill the derivative contract.

Additionally, the leverage used in TQQQ and SQQQ gives investors more risk that arises from this mechanism. For example, an investor holds TQQQ and Nasdaq 100 declines by 33% during the trading day but then bounces right back to flat. Even though the index itself is flat for the day, this investor would have lost all of its investment during the initial drop because of the 3X leverage.

Because of the compounding effect, the overall return of leveraged ETFs will be vastly different from their daily goal in the long-run. Both TQQQ and SQQQ aim to achieve a multiple of the daily performance of the underlying index. This means that over the long run, leveraged ETFs will have a very different return than the daily multiple. Let’s go through an example. Suppose that the Nasdaq 100 went up by 10% for two days in a row. As a response, TQQQ gained 30% each day. Even though TQQQ reaches its 3 times target, the overall return is more than 3X of that of the index because of the compounding effect. This means that over a longer period, leveraged ETFs could return 6X or 9X of the return of the target index, making them more volatile than what their daily objective appears to be.

| Day 1 Change | Day 2 Change | Overall Change | |

| Nasdaq 100 | 10% | 10% | 21% |

| TQQQ | 30% | 30% | 69% |

| TQQQ/Nasdaq | 3X | 3X | 3.29X |

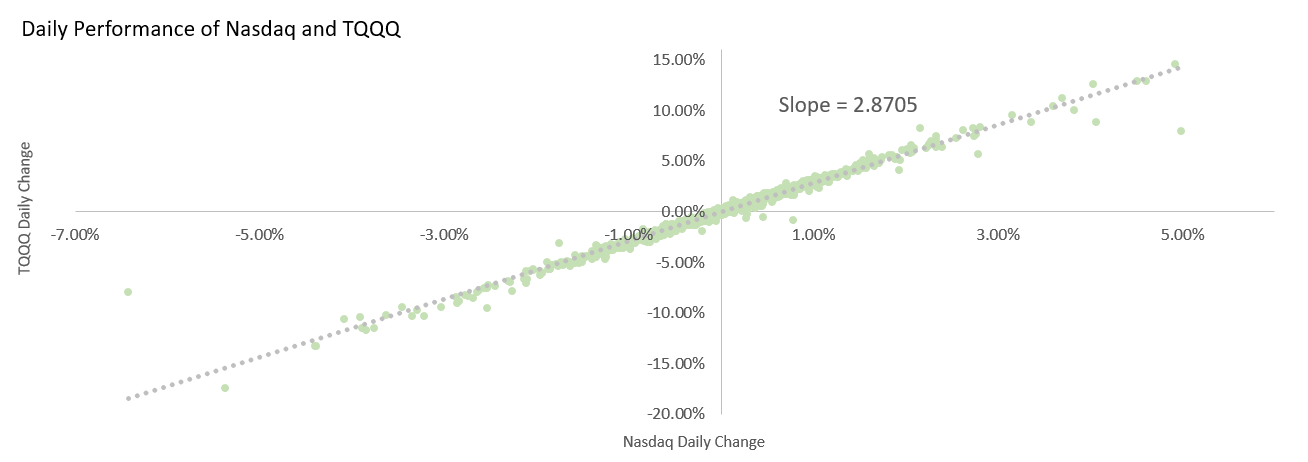

Lastly, leveraged ETFs sometimes fail to reach the desired multiples. A 3X leveraged ETF might return 2.5 times of the index return on some days and might even go above 3 on other days. The 3X is a target but not a guarantee.

We plotted the daily change of TQQQ and the Nasdaq 100 on a graph for the past five years. Mostly, TQQQ has a predictable correlation with the Nasdaq 100. However, the long-term slope is 2.87, slightly below the target multiple of 3. Additionally, you can see that there are a few days when the correlation deviated further from the long-term trend line.

There are many reasons that the funds cannot achieve their goals and all of them are out of the control of the investors. Consequently, investors also bear this risk when they invest through leveraged ETFs.

TQQQ and SQQQ – high risk high return

With its 3X and -3X leverages, TQQQ and SQQQ seem simple and straightforward at first. However, because of its structure and usage of derivatives, leveraged ETFs are more risky and volatile than simply multiplying the risks by 3. Leveraged ETFs are advanced investment tools suitable for investors who thoroughly understand how the fund operates.