For many people, wealth is an aspiration and a life goal. While it doesn’t guarantee a great life, money certainly gives you the means to pursue happiness and fulfillment. How to build wealth is a question worth your time considering.

Anyone can build their wealth with commitment and a good understanding of personal finance. You don’t have to wait until you are older to start building wealth for yourself. In fact, the earlier you start the more wealth you can accumulate. In this article, we will discuss what wealth building is and how to take concrete steps to build your personal wealth at any stage of your life.

What is wealth?

Does having a high income mean that you are wealthy? Not necessarily.

Wealth is often confused with income, but they are quite different when looked at closely. Wealth is the accumulation of money and assets, while income is the inflow of money. You can think of wealth as a lake and income as the river that pours fresh water into it. A robust incoming stream certainly helps keep the lake healthy. But if the outflow is bigger than the inflow, the lake will dry up eventually.

Therefore, high earners don’t necessarily have large wealth. Without conservation and wise spending decisions, one can burn through their paycheck very quickly, leaving them with no savings. Thus, income is only one of the factors that affect wealth. How you spend and save is equally important to building personal wealth.

How to measure wealth?

Personal wealth is best measured by one’s net worth, calculated by subtracting their liabilities from their assets.

Net Worth = Assets – Liabilities

This calculation is simpler than it appears. You can calculate your net worth by subtracting what you owe from what you have.

| What You Have | What You Owe |

| Cash | Credit Card Debt |

| Savings | Student Loans |

| Retirement Savings | Car Loans |

| Investments | Mortgages |

| Real Estate | Other Debts |

| Cars |

As you can see, a person’s net worth reflects their financial strength. When you have a lot in savings, you are likely to have a high net worth. But if you are in debt, your net worth will be negatively affected by it.

How to build wealth?

To build your wealth is to accumulate assets while reducing your liabilities. Anything that can accomplish these two tasks can help you build wealth!

Accumulating assets

Accumulating assets is all about creating a positive cash flow. When you have more income than expenses, you will have a positive cash flow. A positive cash flow leaves more money in your pocket each month. On the other hand, a negative cash flow drains your wealth and is not sustainable. To create positive cash flows, you must boost your income while cutting expenses.

To increase your income, actively seek out new opportunities and challenges. This could mean different things for different people. It could be that you should brave an awkward conversation and ask for a well-deserved raise. Maybe you should start looking for better opportunities with a higher salary. You can also increase your income by making your hobbies pay. If you are an artist, try selling your paintings on Etsy or eBay. Having a side hustle not only gives you extra bucks but also helps you diversify your income. Hey, maybe your online shop will eventually become your full-time job. You never know!

To cut expenses, create a smart budget and follow through with discipline. While budgeting has a bad reputation, a good budget doesn’t have to be boring or restrictive. A smart budget allocates money to things you like and help you avoid spending guilt. When you make a budget, you also pick up automatic savings such as forgotten subscriptions or transportation cards.

The more you can increase income and reduce spending, the more money you will save each month. This surplus will then be added to your wealth. If you go on and invest it, this money can further generate more wealth for you!

Reducing liabilities

The second part of building wealth is to reduce your liabilities. Debt, mortgages, and student loans not only reduce your wealth but also drain your savings with each interest payment. Often these debts have high interest rates.

Hence, it is highly advised to first pay off your debts before investing.

An 8% interest payment avoided is as valuable as an 8% return on your investment. While you might not always receive an 8% return from your investment, you are guaranteed to save on that interest when you pay off your debt.

The secret weapon to building wealth – the compounding effect

The wealthiest people didn’t get there simply by saving or cutting expenses. They know how to put their money to work by investing. Contrary to popular belief, investing is not an exclusive club for the rich. New investors often overlook a very powerful ingredient for building wealth – the power of time. While larger investments bring in larger returns, a small investment can also create meaningful wealth with the advantage of time. The reason that time is so effective in creating wealth lies in the power of compounding.

Compounding is the idea that the return and interest from your investment can be reinvested to make even more money for you.

For example, when you invest $10,000 at an 8% interest rate, you will receive $800 in interest in the first year. However, the next year your return will be $864 because that $800 interest will also generate an additional 8% return of $64. Through compounding, your wealth can snowball over time!

As you can see in this chart above, initially the return is not impressive. However, it grows to become very substantial. The earlier you start investing the more your growth can snowball to build meaningful wealth for you.

Concrete steps to build your wealth today

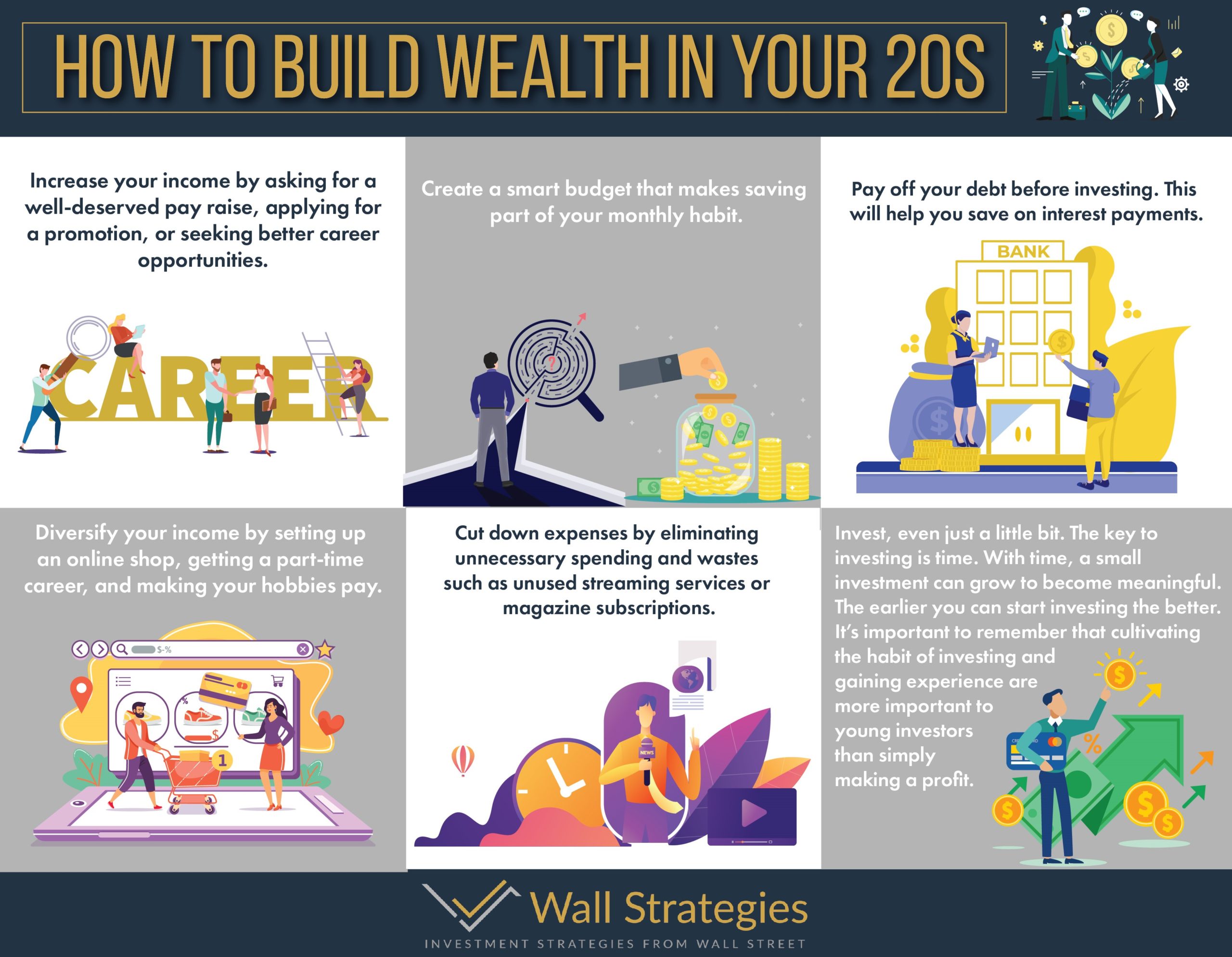

- Increase your income by asking for a well-deserved pay raise, applying for a promotion, or seeking better career opportunities.

- Diversify your income by setting up an online shop, getting a part-time career, and making your hobbies pay.

- Create a smart budget that makes saving part of your monthly habit.

- Cut down expenses by eliminating unnecessary spending and wastes such as unused streaming services or magazine subscriptions.

- Pay off your debt before investing. This will help you save on interest payments.

- Invest, even just a little bit. The key to investing is time. With time, a small investment can grow to become meaningful. The earlier you can start investing the better. It’s important to remember that cultivating the habit of investing and gaining experience are more important to young investors than simply making a profit.