Leveraged ETFs such as the popular TQQQ can be extremely attractive with its promise to triple your investment returns. But TQQQ is a more complex product than your average index ETFs. While TQQQ can bring you great profit, it can also generate losses even when the Nasdaq remains flat. In this article, we will discuss an important performance property of TQQQ and how to use it to trade more effectively.

What is TQQQ?

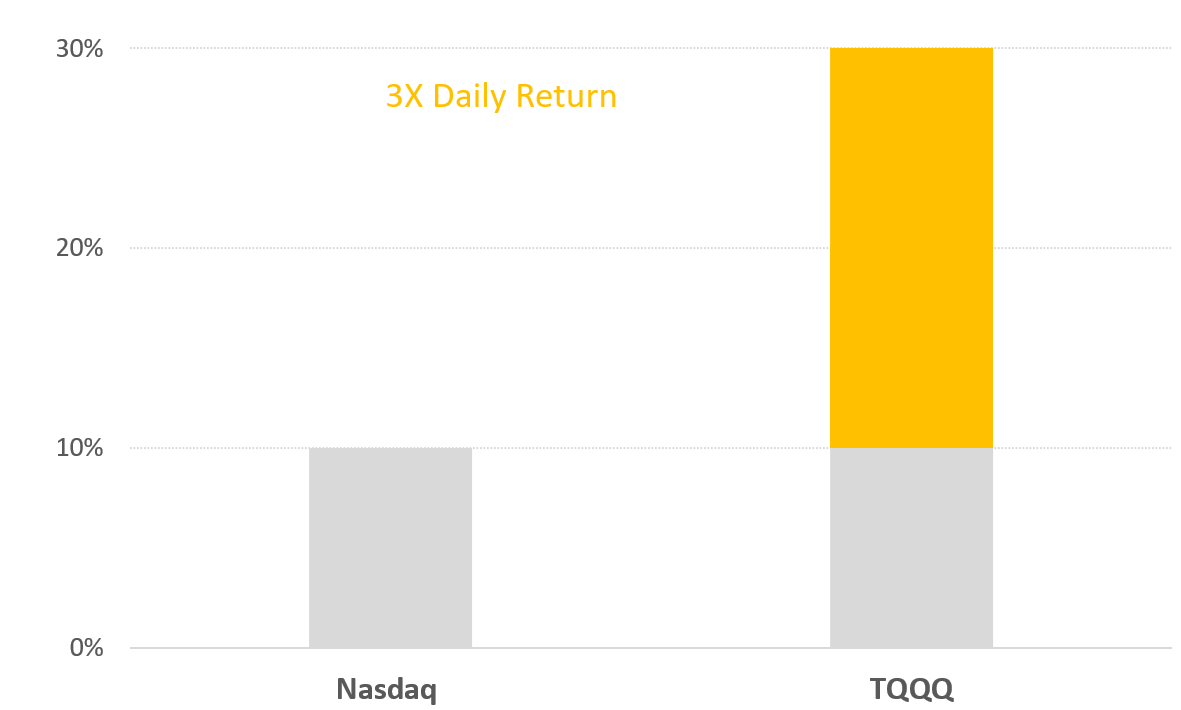

TQQQ is a leveraged ETF designed to deliver 3 times the daily return of the Nasdaq 100 index. For example, on a day when the Nasdaq goes up by 1%, TQQQ should have a 3% price growth. Conversely, when the Nasdaq goes down by 1%, TQQQ will also triple the loss and post a -3% daily performance.

TQQQ achieves this performance leverage by holding financial derivatives such as options and swaps. Yet, because TQQQ is an ETF, it trades just like a normal stock from the investor’s point of view. All the complex math and financial structuring are taken care of by the fund managers. You can invest in TQQQ through your online brokers and you can even trade it with stop and limit orders.

The puzzle of TQQQ performance

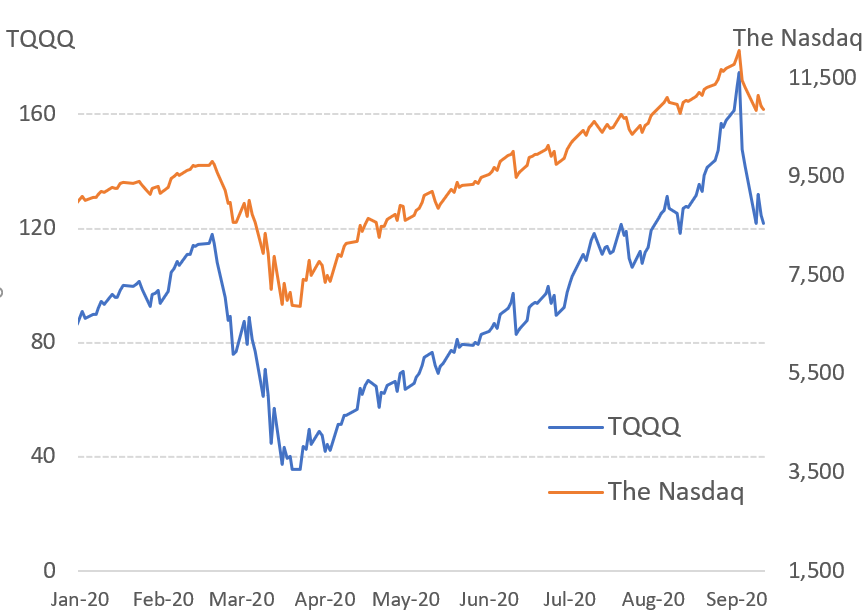

While the return mechanism for TQQQ seems straight forward, investors who bought it thinking they will receive 3X the annual return on Nasdaq might find themselves disappointed. For example, from the beginning of 2020 to September 11th, the Nasdaq has posted a 19.37% return. One might expect TQQQ to triple the gains and return 58.12% (19.37% times 3). However, the actual return investors received was only 33.98%. So where did the other 24% go?

The answer to this puzzle lies in the design of TQQQ and the compounding effect. TQQQ is designed to replicate 3X the daily performance of the Nasdaq. The word “daily” is the key here. It turns out, even when TQQQ perfectly tracks the Nasdaq, which it doesn’t always achieve, the compounding effect will cause its return to deviate from the 3X leverage over a longer period. Let’s explore how this works with a thought experiment.

Let’s assume the Nasdaq went up by exactly 10% for two days straight. TQQQ did its job and went up by 30% each day.

| Day 1 Change | Day 2 Change | Cumulative Change | |

| Nasdaq | 10% | 10% | 21% |

| TQQQ | 30% | 30% | 69% |

| TQQQ/Nasdaq | 3.00 | 3.00 | 3.29 |

The overall return for the Nasdaq for these two days is 21%. On the other hand, the return for TQQQ is 69%. Because 69% is greater than 63% (21%*3), TQQQ’s overall return for these two days is in fact more than 3 times the return of the Nasdaq.

This example shows us that even when TQQQ perfectly triples the daily performance of the Nasdaq, its long-term growth rate will deviate from the 3X factor. This is because the 3X leverage compounds daily and the compounding will create a variance that drives the actual return rate away from the daily 3X leverage. This variance caused by the compounding effect turns out to be the key to trading TQQQ successfully and profitably.

The key to trading TQQQ – understanding market momentum

The compounding effect turns out to play a huge role in your investment success with TQQQ. First, let’s revisit the previous example. When the underlying index goes up continuously, the compounding effect will increase your leverage. In the previous example, the actual return of TQQQ is 69% while the Nasdaq went up by 21%. By investing in TQQQ, you are receiving 3.29 times the return of the Nasdaq. This shows that during a strong market growth period, the 3X daily leverage can compound and deliver even higher growth.

| Day 1 Change | Day 2 Change | Cumulative Change | |

| Nasdaq | 10% | 10% | 21% |

| TQQQ | 30% | 30% | 69% |

| TQQQ/Nasdaq | 3.00 | 3.00 | 3.29 |

However, the compounding effect can also be devastating if the underlying index has high volatilities and trade within a range instead of moving up or down decisively. Let’s imagine a scenario where the Nasdaq first goes up by 10% and immediately drops by 10% the following day. Here, the net change of your investment in the Nasdaq is -1%. By design, TQQQ went up by 30% and down by 30% the following day, perfectly tripling the return of the underlying index.

| Day 1 Change | Day 2 Change | Cumulative Change | |

| Nasdaq | 10% | -10% | -1% |

| TQQQ | 30% | -30% | -9% |

| TQQQ/Nasdaq | 3.00 | 3.00 | 9.00 |

However, when we look at the overall result, TQQQ went down by 9% after the two days while the Nasdaq only dropped by 1%. In this case, TQQQ’s loss is 9 times that of the Nasdaq! (If you are interested in understanding why this is the case, we will explain the mathematical reasoning with some algebra at the end of this article.)

The compounding effect gives TQQQ a remarkably interesting property that investors must understand to successfully trade TQQQ. When the underlying index, the Nasdaq, has a strong performance over an extended period, TQQQ’s compounding effect multiplies the daily gains and gives you an even higher return. However, during a market where the underlying index trades between a range (with mixed performance but no actual breakout), the compounding effect works against you and causes you to lose money while the Nasdaq might be flat overall.

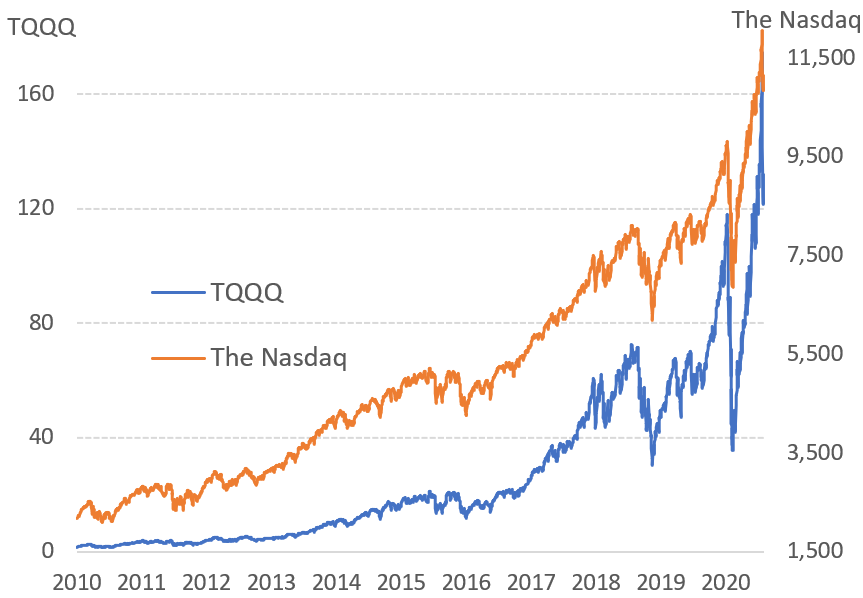

We can verify this property by looking at this historical graph of the Nasdaq and TQQQ. Since 2010, the Nasdaq has a very clear positive slope and upward momentum. This trajectory is great for TQQQ investors as the ETF can multiply the gains and post even greater returns. In fact, from 2010 to 2020, the Nasdaq had a 398% gain while TQQQ posted an astonishing 6,934% gain.

Conversely, when we just look at the performance of the Nasdaq since the beginning of 2020, we can see the index has high volatility and no clear directional momentum. Consequently, the mixed performance from the Nasdaq led to a disappointing TQQQ performance. While the Nasdaq went up by 19.37%, TQQQ only went up 33.98%.

Is TQQQ a good investment?

Your investment success on TQQQ critically depends on the momentum in the market. TQQQ is most beneficial to investors when the market has a clear and sustainable trend. The compounding effect can create greater gains for investors. However, if the underlying index stays mostly flat with ups followed by downs, the compounding effect will reduce your return or even eat away your investment. Consequently, during a severely range-bound market with no clear directions, investors are better off investing in non-leverage ETFs such as QQQ. On the other hand, if the Nasdaq has a clear positive momentum, TQQQ can be an effective way to increase your investment returns.

Appendix – the algebra of the compounding effect in TQQQ

To determine the return of the Nasdaq over two days, we can use the following formula.

(1+X)*(1+Y)-1 = XY+X+Y

X = percentage change on day 1

Y = percentage change on day 2

On the other hand, assuming that TQQQ perfectly triples the return of the Nasdaq, the overall return for TQQQ is calculated as the following:

(1+3X)*(1+3Y)-1= 9XY +3X+3Y

If we rearrange these items, we can see that the return from TQQQ equals 3 times the return from the Nasdaq plus 6XY.

9XY +3X+3Y = 3*(XY+X+Y)+6XY = 3* (return of the Nasdaq) + 6XY

This extra 6XY term captures the compounding effect. When X and Y are greater than zero, your return on TQQQ will be 6XY higher than 3 times the return on the Nasdaq. On the other hand, if X is positive and Y is negative, your return will actually be 6XY lower than the 3 times the return on the Nasdaq.