The Coronavirus has spooked the stock market. Before the outbreak, the average daily change in the S&P was 0.6% in either direction. Since March, the daily swing rose by six times to a staggering 3.6%. With wild fluctuations in the stock market, investors face heavy pressure to find the best time to invest. However, it’s almost impossible to time the market perfectly. In a volatile market, dollar cost averaging stands out as an effective investment strategy to minimize the timing risk of investing and reduce stress.

What Is Dollar Cost Averaging?

Dollar cost averaging is an investment strategy where an investor puts a fixed amount of money into the stock market on a regular schedule. Instead of putting all your money into the market at the same time, you invest only a portion of it monthly or weekly when you use dollar cost averaging,

For example, let’s say you have $5,000 in savings that you would like to invest. One way to invest this money is to invest all $5,000 at the same time. This is called a lump sum investment. Alternatively, you can invest $1,000 monthly over five months. This is dollar cost averaging. Although it sounds simple, dollar cost averaging has a few useful benefits in a volatile market!

The Benefits of Dollar Cost Averaging

Reducing Timing Risks

The main benefit of dollar cost averaging is to reduce the risk of bad timing. When you invest all your money in a lump sum, you risk entering the market at the wrong time. For example, you might invest your money when the shares are overpriced and thus receive fewer shares for your money.

On the other hand, dollar cost averaging reduces your risk of entering the market at a bad time. Following a dollar cost averaging strategy, investors invest a fixed amount of money into the market regularly regardless of how the share performs. The actual cost basis of your investment is the average of all your investments.

This strategy comes with an interesting behavior– it automatically buys more shares when the price is low and fewer when the price is high. Because you only put a fixed amount of money into the market each month, when the share price is high, your money will buy fewer shares as a result and vice versa. Often, this is a good buying strategy for stock investing, as it helps investors avoid overpaying.

Less Stress and Fewer Regrets

Timing the market is stressful and often counterproductive, especially in a volatile market. No one can predict the future. When you invest all your money at the same time, you put tremendous pressure on yourself and still can’t guarantee an optimal entry point. Investing with a dollar cost averaging strategy eliminates much of the anxiety of getting the timing perfect and the regret of failing to do so. It frees investors from the struggle to predict the future, so they can instead focus on the long-term potential of their investment.

Supporting Healthy Saving Habits

Sticking to a dollar cost averaging schedule also helps you form a habit to save and invest. Taking a fixed amount of money from your paycheck monthly and put it into the market is a great way to form a healthy saving and investing habit.

A Real-life Example of Dollar Cost Averaging

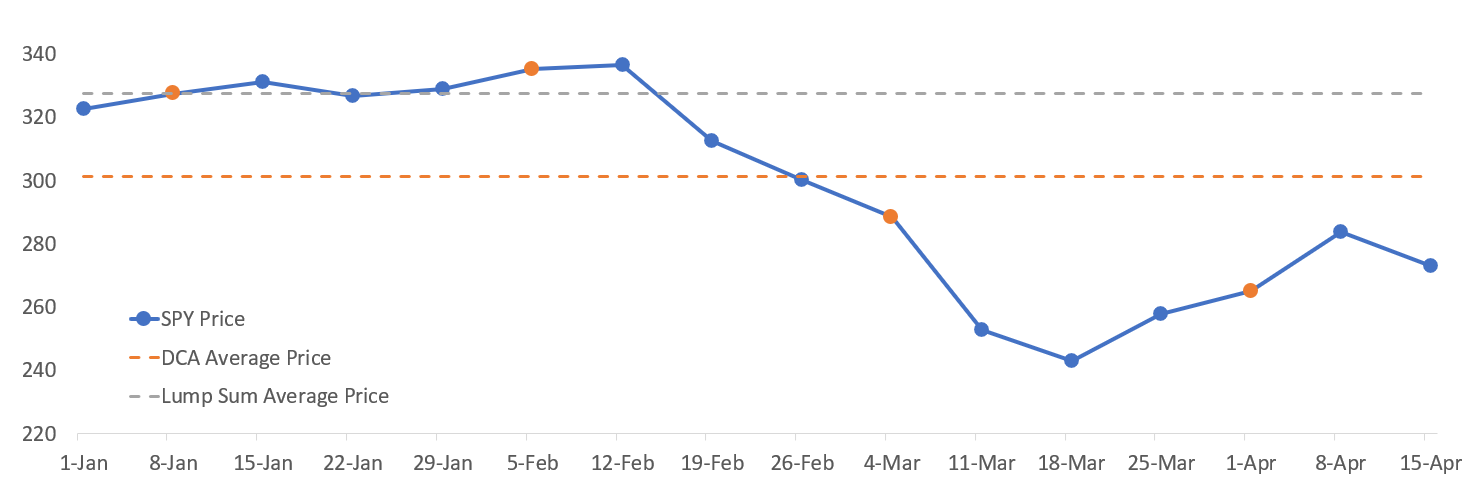

Next, we will illustrate how cost dollar averaging works through an example with real market data. Let’s say on January 2nd, you made a New Year’s resolution to invest more money in the stock market. You have $2,000 that you would like to invest in SPY, an ETF that tracks the S&P 500. You watched the market for a few days. The S&P 500 was fairly stable without major ups and downs. So you put all of the $2,000 into SPY on January 8th and bought 6.1 shares at $327.45 a share. The market continued to grow gradually for a month and everything seemed fine.

However, in an unfortunate turn, the S&P declined sharply in March due to the Global spread of the Coronavirus. The S&P declined by over 20% in merely a week. Now you could buy SPY at a much cheaper price, but you are all out of money. The timing was not in your favor and no one could have predicted the downturn either.

Alternatively, if you invested through dollar cost averaging, you would stick to a fixed schedule of investing $500 into SPY each month. Although you would still have bought shares during the highs in January and February, you could take advantage of the price drop in SPY and buy more shares in March and April. Your investment schedule would look like the chart above. The orange dots represent your dollar cost averaging investments. By having four small investments, the dollar cost averaging strategy effectively reduces your timing risk. As you can see in the graph, the average share price from dollar cost averaging is much lower than a lump sum investment.

As a result, you would receive more shares of SPY with your $2,000 investment. In the table below, we calculated the actual shares bought under both the dollar cost averaging approach and the lump sum approach. When you invest all your money in one go, you received 6.1 shares of SPY. On the other hand, with dollar cost averaging you would receive 6.6 shares.

Timing the Bottom V.S. Dollar Cost Averaging

Timing the bottom is an expression investor use to describe trying to invest in a stock when it is at its lowest point. Hypothetically, if you timed the market just right, your reward is also bigger than investing in installments. While hindsight is 20/20, consistently predicting the market is extremely difficult.

Since March, the Coronavirus has made the US equity market more unstable and unpredictable than before. Moreover, the market is not out of the woods yet. Economists and traders are struggling to understand the real impact the virus has on the US economy. Putting all your money into the market at once is even riskier than usual.

On the other hand, in a volatile market, dollar cost averaging is a conservative strategy that averages out the day-to-day fluctuation in the market. This enables you to focus on the long-term potential of your investments. While you will probably not catch the very bottom of the market with a dollar cost averaging strategy, you also will not enter at the worst time. This makes dollar cost averaging a conservative approach suitable for investors who do not want to time the market. This strategy is more useful than ever during a challenging market like the one we are in right now.

Instead of trying to time the bottom of the stock market, investors can use the dollar cost averaging strategy to invest their money. This will help you continue to increase your investment during the crisis without worrying about entering the market at an unfavorable point.