If you were born after 1990, chances are that you may have never written a check before. A raincheck maybe, but probably not a real physical check. With services like Venmo and PayPal, fewer and fewer people feel the need to carry checkbooks to pay for their expenses. Once a crucial life skill, writing a check is becoming a lost art full of mystery. But writing a check is not hard and it is still a useful skill to know even today. So here is a step-by-step guide on how to write a check properly and with style!

What the heck is a check?

A check, or cheque for our British and Canadian readers, is a paper instrument that instructs the bank to pay a specific amount of money to a specific recipient. For example, you might can a $200 check for a particular charity you care about or to pay your plumber. Only the person whose name appears on the check can cash the check and get money from it.

How to write a check?

Tearing off a check and flicking your wrist to hand it out can be satisfying and even dramatic, but writing your first check could be tricky. Don’t worry. We have broken down the steps to write a perfect check that is both effective and safe. Just follow these steps and you will be confident about your check-writing skills in no time.

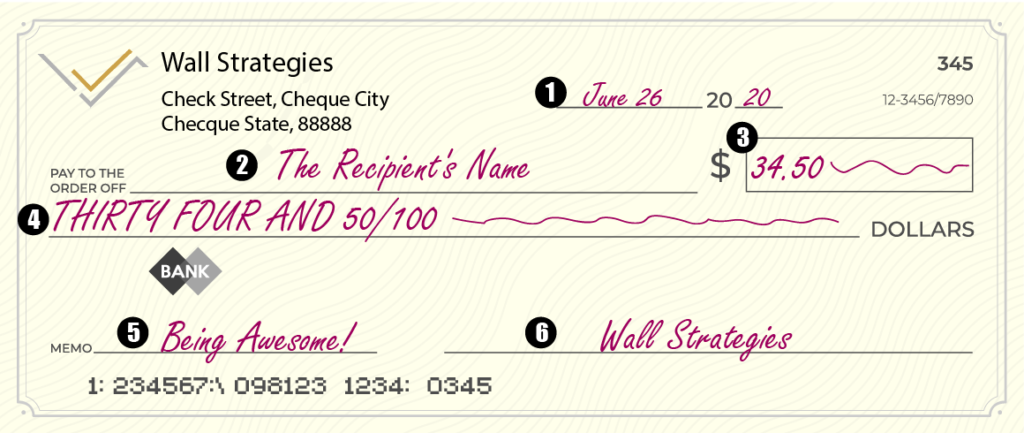

A check has a few parts you must fill in for it to be valid. Now, let’s talk about how to complete each field properly so you can hand out your checks with confidence.

- The date: each check must come with the date the check was written on. You can also write a future date on a check if you would like it to be cashed later in the future. Unfortunately, writing a future date does not prevent the check from being cashed before then. The future date is not legally binding, but rather a reminder for the recipient.

- The recipient’s name: for the check to be valid, the payee’s name must be correct. This is the name of the person or company you are paying. It is important to get their name and spelling exactly right. Otherwise, they might have trouble cashing the check at the bank. This especially true for companies because they often come with different classifications such as Inc. or LLC.

- The dollar amount in number: in this box, you should fill in the dollar amount of the payment. While this might seem straightforward, here are a few tips you should follow to prevent fraud. First, start writing the number from the leftmost border. This prevents people from adding a few extra digits to the number. Second, always include two digits after the decimal point. For example, write “8.00” instead of “8”. This stops people from adding zeros to the number. Lastly, if you want to be extra safe, you can add a dash after the number so no one can add anything, period!

- The dollar amount in letters: while repeating the amount in letters seems redundant, it is actually a crucial step. In case of a discrepancy between box 3 and box 4, the dollar amount written in letters will decide the final payment amount. So it’s important to get this one exactly right. Start writing the amount from the leftmost to prevent fraud. Use capital letters and end with a dash across the empty space. In case you need to write a check for cents, the correct way is to write the number of cents followed by a “/100”. For example, 45 cents would be “45/100” when written properly on a check.

- Memo: this line is the only part that doesn’t affect the validity of the check. You can even leave it empty. The memo is basically a Venmo caption. You can get creative with it, and even funny! Sometimes, if you are paying a company, they might ask you to write down your account number so they can reference it. In that case, you should limit your creativity and follow the instructions.

- Signature: the last step is to sign your check. And voila, you have written a complete check following our best practice for check-writing!

If you are also a fan of Saturday Night Live, like many of our writers at Wall Strategies, here is an hilarious SNL skit that will also teach you how to write a check.

How to void a check

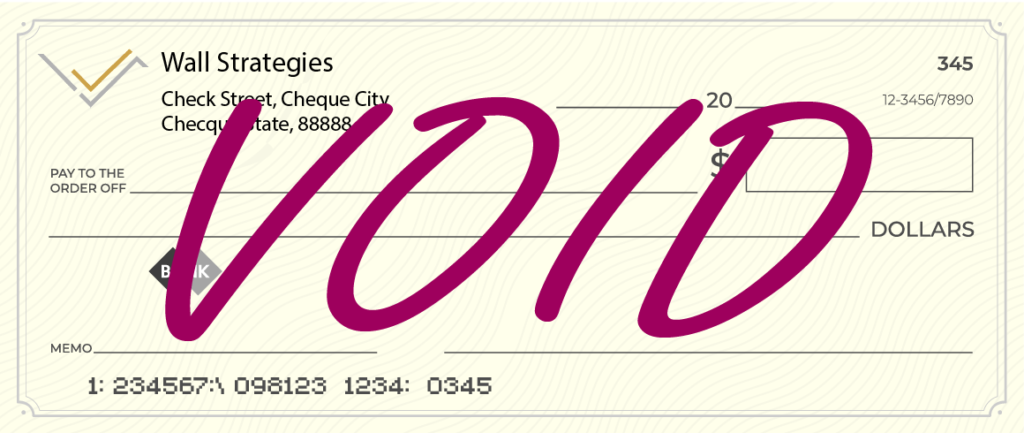

Voided checks are sometimes used to share your banking information to set up electronic payments. Basically, a voided check helps people verify your account number and routing number which are shown on the bottom of your check. However, sending an empty check is like giving your house key to a stranger. You must first void the check before sending it to anyone. Voiding a check makes it invalid to be used as payment.

To void your check, write “VOID” in large capital letters across the check. If you have a thick sharpie that you are saving for a special occasion, this is the time for it to shine!

How long are checks good for?

Most personal and commercial checks are generally valid for 180 days or six months. If you receive a check, it’s an excellent idea to cash it as soon as possible. With your smart phone, you can even cash a check online!

Can you cash a check without going to the bank?

Checks are unpopular because they are inconvenient. In the past, you must go to a bank to cash them. Fortunately, checks have also evolved in the 21st century. Now, you no longer need to go to a bank physically to get your money. Instead, you can cash a check at home with mobile apps. Banks such as Chase and Bank of America have apps that allow you to simply take a picture of a check and instantly deposit it to your account.

So, why do people still use checks?

Electronic payments are gradually replacing checks, but they are not going away completely just yet. Unlike other dated practices, checks are still being used relatively frequently despite better payment methods being available. So why are people still using checks? Well, it turns out that using checks can sometimes be cheaper and faster than electronic payments.

No processing fee

You might have noticed that some small businesses only accept checks. Plumbers, landlords, and HVAC professionals often prefer checks over electronic payments. And there is a good reason for it. From the merchant’s perspective, accepting credit card payments is costly. Payment processing companies charge around 3% to process a credit card payment. On the other hand, checks, though inconvenient, are free. When the payment amount is large, the 3% fee adds up quickly. That’s why checks are still a preferred payment method for many small business owners.

Faster money transfer between accounts

It’s perfectly ok and legal to write a check to yourself to transfer money between your accounts. The reason why someone might make the transfer by writing themselves a check is because it is faster. But how?

Depending on the bank’s policies, electronic transfers can take a few days to complete. If a weekend is coming up, the wait will be just longer. When you are in a hurry, writing a check allows you to complete the transfer faster. All you have to do is to write your name on the payee section and follow the same steps we showed you earlier. Once you cash the check, the bank will clear the money the same day or the day after! Surprisingly, old technology sometimes can be faster than the new one!

Old habits die hard

Although the younger generation has mostly given up on checks, the older generation still uses them frequently. For example, many millennials still receive birthday checks from their grandparents every year! Using checks has become a tradition and habit for some people. Writing on checkbooks feels more intuitive than clicking through the Venmo app.

The government is also a major user of checks. For example, to combat the Coronavirus crisis, the U.S. government issued stimulus checks. While some Americans received direct deposits, many received physical checks in their mailboxes instead.

Checks can be fun

Checks don’t have to be serious and all black-and-white. In fact, some checks can be fun and show off your personality. For example, you can get checks with Disney characters on them! Or even animal-themed checks!

The risks of using a check

One of the key reasons that checks are becoming less popular is the risk of fraud. Following the steps we discussed above when writing a check can help prevent people from changing the amount of your check. But there are still other risks.

A checkbook is not password-protected. When it falls into the wrong hands, people can forge your signatures and have themselves a payday. Additionally, checks have important personal information on them such as your address, bank routing number, and account number. You do not want identity thieves to get their hands on this information.

Accepting checks from strangers can also be risky because they might bounce. Having a check does not guarantee that you will be paid. Unlike electronic payments, you can receive a check from someone even when they have no money left in their account. So it’s best not to take checks as payments from strangers, but checks from your grandma should still be ok!

Although fewer and fewer people use checks daily now. Using a check still has some benefits and most importantly charms. Checks will remain as a cultural symbol in our society, from the giant check at ceremonies to those birthday checks from your grandparents. We hope this article helps you understand how to write a check properly. So next time someone asks you for a check, you can whip out your checkbook and write one with style and confidence.